The salary calculator forms a crucial part of any company, business, firm, or institute. It not only helps the employer calculate the salary of the employee but also helps the workforce to understand more about their salary contents. The tool makes salary calculations simple & easy to understand.

What is a salary?

A salary is a fixed, mutually agreed that has been decided after negotiation between the employer & the employee. The employee receives the salary at the end of the month from the company, business, organisation, and the institute.

In some cases, it can be on a weekly or bi-weekly basis. In most countries, a monthly salary is followed. The salary is broken up and mentioned clearly in the offer letter or can be found on the payslip.

Once the employee works in the company or firm for a few months or years, they can negotiate the amount with the manager or HR.

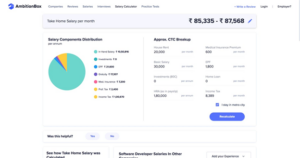

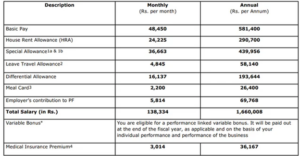

Source: https://www.ambitionbox.com/salaries/take-home-salary-calculator

In some cases, if the workforce is not happy with the salary amount, then they usually resign from the job, and look for better opportunities. In many organisations & corporations, it is also known as CTC or cost to the company.

This is the amount that the employee costs to the company. The CTC is the actual take-home salary or what the employee receives at the end of the month. In most businesses, firms, and institutes a monthly salary system is followed.

The elements of a salary slip

It is important to know some of the most crucial elements of the salary slip. That is because the salary slip contains some of the most vital components that any employee or the workforce should be aware of.

Below are some of the salary-related terms to know.

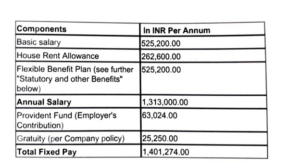

CTC (Cost to Company): The CTC refers to the complete salary package. It includes all benefits that will be earned by the employee from the company, without tax deductions. This is the payment that the employers have agreed to pay the workforce for their service. Usually, the basic salary comprises of 50% of the total salary. Here, there is no formula to understand the basic pay. It depends on the employee’s work experience, designation, and skills.

Gross salary: The gross salary is the amount that is provided before the deductions are done on it. This consists of the basic salary, house rent allowance (HRA), and the provident fund. There also comes the travel allowance, medical allowance, and also the professional tax.

Gratuity: The gratuity is a monetary benefit that is provided for the employee services. The employee needs to have worked in the company or the firm for more than 5 years to receive the gratuity. But, in the case of death, or permanent disability due to an accident, it can be paid earlier.

House Rent Allowance (HRA): The HRA refers to the home rent allowance. This is required for workers or employees who are living in a rented property. When the employee is residing in a metro, then the HRA comes to around 50% of the basic salary. When living in a town, then it is around 40% of the basic salary. According to Section 10(13A) of the Income Tax Act, 1961, the HRA is fully tax-exempt.

Leave Travel Allowance (LTA): Likewise, there is the LTA, which enables the workers to make use of during their vacations. This amount can be used for the air ticket and the train ticket. According to the Section 10(5) of the Income Tax Act, 1961, tax exemption can be provided for two holidays in 4 years. For getting the tax benefit, the employee needs to submit the proof of travel.

Special allowance: The special allowance is like a personal amount that can be used for personal expenses, and it is completely taxable.

Bonus: The bonus is an additional amount that is provided to the employees once or twice a year. The amount can vary according to the designation of the worker or the employee. Besides, the amount can be taxed.

Employee Provident Fund (EPF): The EPF is a crucial payment that is received by the employee at the end of their working term. This could be after they have retired at the age of 60 years in India. However, in some institutes, it could be 65 years. This depends on what was agreed upon. The employee needs to pay 10-12% of their basic salary to be eligible for the EPF. The employer or company will match the contribution in the EPF account. It is tax-deductible up to Rs. 1.5 lakhs under Section 80C of the Income Tax Act, 1961.

Professional tax: This is a mandatory tax to be paid to the state government. The professional tax is usually around Rs. 2500 per year and not more.

Tax-free Allowance: The tax-free allowance includes the travel allowance, uniform allowance, and the daily allowance. Moreover, it also comes with the academic allowance, and these allowances are exempt from tax.

How to use salary calculators?

Source: https://www.reddit.com/r/IndiaTax/comments/1da8itu/want_help_with_my_tax_calculation_and_in_hand/

Using the in-hand salary calculator the employee can analyse their earnings. The tool makes use of precise computations to provide the best possible answers. To understand their monthly earnings, the employee can make use of the salary calculator every month.

However, all the needed details should be provided on the calculator. The calculator offers everything that is needed to know. Besides, it is quite easy to use as well. Once all the needed details have been entered, the users need to click on the calculate button for the results.

Benefits of Salary Calculator in India

Source: https://www.naukri.com/campus/career-guidance/how-to-calculate-salary-structure-for-freshers

There are many benefits of using the simple interest calculator in India. A salary calculator can be beneficial to an employee in the following ways:

Transparency: The salary calculator can provide immense clarity on the structure of the salary. Besides, it also helps to understand the impact of the various elements that are contained in the salary package.

It saves time: The salary calculator saves employees time. There is now no need to do the calculations manually as the tool can provide the individuals with all the details that they want, with instant & accurate results.

Helps new employees understand the salary structure: The salary calculator can help the new employees understand more about the deductions & the pay allowances that they are eligible for. It is like an educational tool that helps the employees or the individual to learn more about their salary.

Accurate value: The salary calculator helps the employee to gain knowledge on their annual & monthly income. Besides, there is also the mention of EPF, and others as well. This helps them to plan their monthly & annual budget.

Helps to plan the tax: The main benefit of using the salary calculator is to help with the tax planning. The employee can now make use of the tool to learn more & also to understand more about tax planning.

Personalised insight: The tool offers a personal understanding of the aspects of the salary. Besides, it also enables the employee to understand how the allowances & deductions can affect the earnings.

How to increase the salary?

Here are some ways to increase the salary:

Update the skills: Any employee or worker may want to enhance their skills & educational qualifications. This has a substantial influence on the salary & pay package offered by the company or organisation. This is because the employee develops a certain amount of expertise in a specialised skill that is in great demand in the industry. Hence, it is necessary to stay updated on the skills & complete online courses once in a few years to enhance the knowledge.

Gain more experience: As the employee gains more experience in a particular field, then they are in great demand. Besides, the employee can command a higher pay rate than somebody else who has a lower number of years of work experience. Somebody with 20 years in a field has more market value than somebody who has 10-15 years.

High performance: Consistent good performance is crucial to convince potential clients & companies about the value that the employee can bring to them. When the employee is able to showcase their exceptional performance, then the company or business won’t mind paying more to bring the worker on board.

Solid negotiation skills: Sometimes having a solid negotiation skill pays for the hard work & effort. Many managers & HRs tend to test the potential candidates if they are aware of their worth in the market.

Job change strategy: When the employee or the worker feels that their pay structure is quite low for their work experience & skills, then they can do some research to change their jobs. This is the best way to get a higher pay for themselves. Sometimes, when the management comes to know that the employee or worker is resigning, then they provide them with a higher pay structure.

What is the new tax regime?

The new tax regime was introduced in the year 2020. This was during the presentation of the Union Budget 2020. The regime was applicable from 01 April 2020, FY 20-21. It comes with lower tax rates.

Employees and self-employed taxpayers can, however, choose between the old tax regime and the new tax regime. The lower tax rates found in the new regime can be applicable, if the employee is willing to give up exemptions under various provisions of the Income-tax Act, 1961.

In this case, the employer’s contribution towards the employee in a notified pension scheme [under Section 80CCD (2)] can be claimed by the employee or the worker.

Read More : The Importance of Social Media in Business

Conclusion

All in all, the salary calculator can come in handy & useful for several purposes. Besides, providing the employee or the workforce with details about the payment amount, the salary hike calculator offers a precise comprehension of the salary breakdown.

Moreover, when the employee wants to know more about the elements of the salary, then they can make use of it. The best way to understand the elements of the salary can be done effortlessly with the help of this amazing tool, to assess the disposable income and plan the financial goals.

FAQs

What to know about using the salary calculator?

The salary calculator can be used when the employer or employee knows the gross salary and the total bonus. When the information is entered on the calculator, it shows the other relevant salary elements.

How does the calculator determine the basic pay?

The salary calculator determines the basic pay by calculating the basic salary as the percentage of the CTC. However, the percentage may be changed according to the basic salary as received by the employer or the employee.

How to find the TDS on the salary calculator?

The TDS amount is given on the salary slip or pay slip. The salary calculator cannot find or calculate this amount. Unless there are some discrepancies, the employee may want to sort that out with the manager or the HR of the company, business or the firm.

What is a salary?

Salary is a payment that is made by the company to the employee for their service. The salary or payment is given on a weekly, bi-weekly, and monthly basis. The salary consists of many elements including the basic pay, allowances, deductions, and bonuses.

All employees & the workforce require a salary. The salary helps them to survive, and place food on the table at the end of the day for their families. Besides, the employees have various expenses.

However, the salary may vary from employee to employee according to their skills, work experience, and value that they bring to the company, business or the firm.

What is a salary calculator?

A salary calculator is a tool that helps find out the take-home pay. It helps by finding out all the deductions that are there in the complete pay slip. The individual just needs to enter the information in the calculator, and all the details are provided by the tool.

The deductions include employer’s and employee’s provident fund contributions. Then there can be the professional tax and employee insurance. The salary calculator provides the employee with a clear understanding of their take-home money.

What is the difference between CTC & take-home salary?

The CTC is also known as the cost to the company. It is the entire salary package of the employee that comes with all the monetary and non-monetary benefits. Besides, it also comes without the tax deductions.

However, the take-home salary is the amount that a worker gets, when all the deductions have been done from the monthly salary.

How much is the basic salary cost to the company (CTC)?

The basic salary cost is a fixed base component of the worker or the employee. This comes to around 50% of the total gross salary. Depending on the basic pay, it will be subject to taxation. There is no perfect formula for finding out the basic salary, it is determined based on the job title and the role of the employee.

For example, a team leader or manager stands to earn more than the ordinary worker in the franchise. If the employee earns around Rs. 20,000 or Rs. 30,000 per month, then the team leader or the manager can earn around Rs. 40,000 or Rs. 50,000 per month.

However, the final call can be taken by the employer or the management. If the worker or employee is exceptionally skilled & talented, then they can be paid a basic salary that is somewhat higher than the other workers or even the manager.

What is gratuity? What are the eligibility criteria for gratuity?

Gratuity is a monetary way of expressing gratitude to the employee or the worker by the employer for their service. For that, the employee should have worked in the company or the business for more than 5 years.

However, in case of the employee’s death, permanent disability due to an accident at the workplace, or sickness, then the gratuity may be paid before the completion of 5 years.

Does the salary calculator show the deductions?

The in-hand salary calculator can be used by anyone, at any time. The salary calculator shows the deductions on the pay slip. The employee or the worker can find out the details about the tax and provident fund deductions.

Besides, the details of the total deductions are provided. The calculations are done immediately, and the required information can be gathered instantly, without errors. However, the individual needs to ensure that all the correct data is provided to get accurate results.

What is Dearness Allowance (DA)?

The Dearness Allowance is provided by the government to its employees. Besides, the DA is also provided to those receiving pensions. This is done based on a percentage of basic salary to be able to balance the impact of inflation.

However, private sector employees in India will not get the DA. The DA can be considered as an allowance that is meant only for government employees and pensioners. However, private employees can make use of several health & retirement plans & packages offered by LIC.