- The yen rallied on a higher likelihood of a Bank of Japan rate hike in December.

- Core inflation in Tokyo increased more than expected.

- US inflation figures came in line with expectations.

The USD/JPY weekly forecast supports further downside for the pair as the yen finds relief due to the increasing bets for a BoJ rate hike.

Ups and downs of USD/JPY

The USD/JPY pair had a bearish week as the yen rallied on a higher likelihood of a Bank of Japan rate hike in December. At the same time, the dollar eased as market focus shifted to the likelihood of a Fed rate cut in December.

-Are you looking for the best AI Trading Brokers? Check our detailed guide-

Data during the week revealed that core inflation in Tokyo increased more than expected. As a result, traders were pricing a higher chance that BoJ policymakers will hike rates by 25-bps in December. At the same time, US inflation figures came in line with expectations, solidifying bets for a December rate cut.

Next week’s key events for USD/JPY

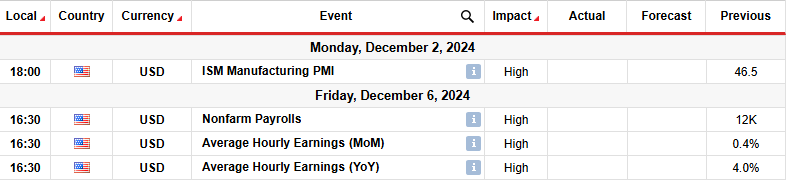

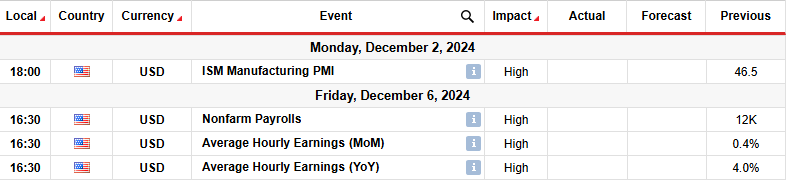

Next week, traders will focus on economic reports from the US, including the manufacturing PMI and monthly employment figures. The PMI report will show the level of business activity in the manufacturing sector.

Meanwhile, the employment report will show the state of the labor market. In the previous month, job growth slowed significantly to 12,000 raising fears of deterioration. Another downbeat month will solidify bets for a December rate cut.

USD/JPY weekly technical forecast: Bears face hurdle at 150.02

On the technical side, the USD/JPY price has reversed to the downside after finding solid resistance at the 156.06 level. Bears resurfaced at this resistance with a bearish engulfing candle that led to a break below the 22-SMA. At the same time, the RSI broke below the 50 level and entered into bearish territory.

-Are you looking for the best MT5 Brokers? Check our detailed guide-

However, the price must now start making lower highs and lows to confirm a new downtrend. At the moment, bears are facing strong support from the 150.02 level and the 0.382 Fib retracement level. A break below this support zone will allow USD/JPY to set its sights on lower support levels including 145.06 and the 0.618 Fib.

Meanwhile, if the price breaks back above the SMA, it might revisit the 156.06 resistance. A break above would confirm a continuation of the previous bullish trend.

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.