- The USD/CAD weekly forecast indicates tariff uncertainty in Canada.

- The loonie collapsed after Trump implemented a 25% tariff on goods from Canada.

- The US economy dimmed with more tariffs.

The USD/CAD weekly forecast is unclear ahead of Bank of Canada’s potential rate cut and softer US dollar.

Ups and downs of USD/CAD

The USD/CAD price had a bearish week as the loonie fluctuated and ended strong amid tariff uncertainty. Market participants also focused on employment data from the US and Canada.

–Are you interested to learn more about forex options trading? Check our detailed guide-

The loonie collapsed on Tuesday after Trump implemented a 25% tariff on goods from Canada and Mexico. However, on Thursday, the president suspended these tariffs for another month, giving relief to Canada’s currency. Meanwhile, data revealed a mixed picture of Canada’s economy as job growth slowed and unemployment fell.

On the other hand, the dollar eased as the outlook for the US economy dimmed with more tariffs. Moreover, weak employment data increased Fed rate cut expectations.

Next week’s key events for USD/CAD

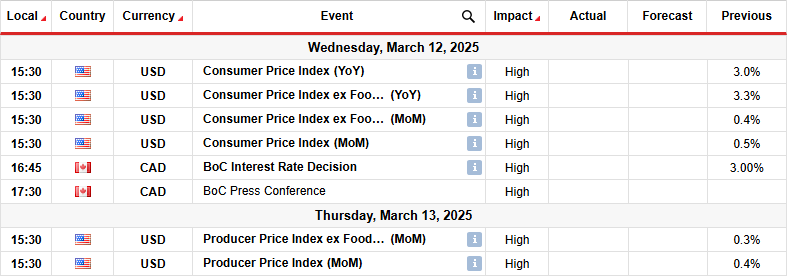

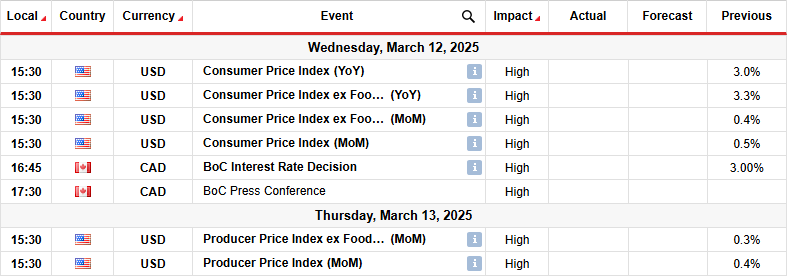

Next week, market participants will focus on US consumer and wholesale inflation data. Additionally, they will focus on the Bank of Canada policy meeting. US inflation numbers will play a significant role in shaping the outlook for Fed rate cuts. Last month, inflation exceeded estimates, leading to a sharp drop in rate cut expectations. This month, economists expect softer inflation, with the annual figure at 2.9% and the monthly figure at 0.3%.

Meanwhile, traders are pricing a 73% chance that the Bank of Canada will lower borrowing costs again on Wednesday.

USD/CAD weekly technical forecast: Bulls struggle to take back control

On the technical side, the USD/CAD price is bouncing higher after retesting the 22-SMA as support. At the same time, the RSI has retested the pivotal 50 level and is ready to climb. This suggests a bullish bias.

–Are you interested to learn more about Thailand forex brokers? Check our detailed guide-

Previously, the price traded in a bullish trend, keeping above the 22-SMA. However, the uptrend paused when bulls failed to break above the 1.4501 resistance level. At one point, the price punctured the resistance but fell back sharply, indicating a rejection of higher prices. This led to a break below the 22-SMA, showing a bearish shift in sentiment.

However, bears only managed to hold control to the 1.4150 support level. Here, bulls returned with renewed momentum and took back control. However, the 1.4501 is still a solid hurdle. A break above this level will allow the uptrend to reach the 1.4801 resistance.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.