- The USD/CAD weekly forecast indicates a dim outlook for Canada’s economy.

- US tariffs on Canadian goods will come into effect in March.

- The dollar surged as traders sought safety amid economic uncertainty.

The USD/CAD weekly forecast indicates a dim outlook for Canada’s economy as Trump plans to implement a 25% tariff in March.

Ups and downs of USD/CAD

The USD/CAD pair had a bullish week as the dollar rebounded amid safe-haven inflows. This week, the dollar was on the front foot as Trump maintained his aggressive push for tariffs in Canada and Mexico.

–Are you interested in learning more about making money with forex? Check our detailed guide-

The US president surprised markets by saying the tariffs would come into effect in March. Analysts had expected another delay to April. As a result, fears of a weaker economy in Canada amid lower demand hurt the loonie. On the other hand, the dollar surged as traders sought safety amid economic uncertainty.

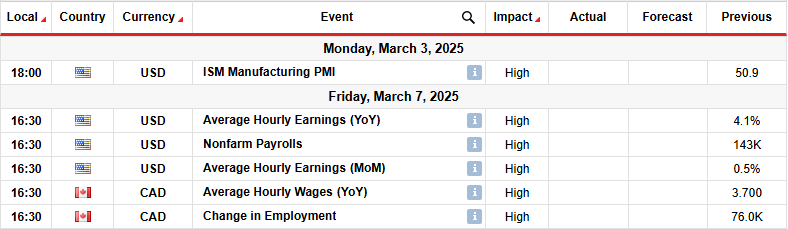

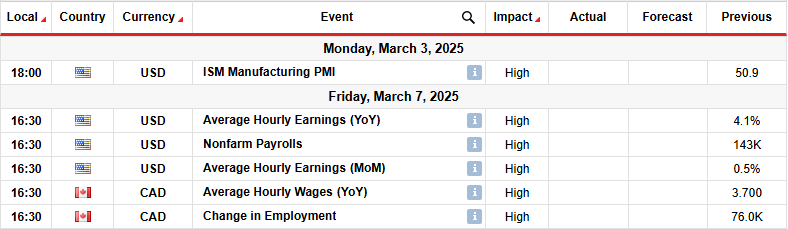

Next week’s key events for USD/CAD

Market participants are looking forward to key reports from the US, including manufacturing PMI and employment. Meanwhile, Canada will only release its monthly employment figures.

Traders will keenly monitor employment numbers from the US and Canada to determine what the Fed and the Bank of Canada will do in the near future. Upbeat reports will lower bets for rate cuts. Meanwhile, a downbeat report will pressure both central banks to cut borrowing costs.

USD/CAD weekly technical forecast: Bulls resurface, targeting 1.4804

On the technical side, the USD/CAD price has bounced back after an attempt by bears to reverse the trend. The price has broken above the 30-SMA, indicating a bullish shift in sentiment. At the same time, the RSI now trades above 50, suggesting solid bullish momentum.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

The previous bullish trend paused just below the 1.4804 resistance level. The price had made a strong bullish gap to this level. However, bears emerged with stronger momentum, closing the gap and forming a bearish engulfing candle. This sudden strength pushed the price below the SMA, challenging the uptrend.

However, bears could not push the price beyond the 1.4150 support level, allowing bulls to return to the market. This return might only be brief to retest the 1.4804 resistance. However, it might also allow USD/CAD to continue its previous bullish trend. If bulls maintain their position above the 1.4400 key level, the price will revisit the 1.4804 resistance.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.