- Market participants are eagerly awaiting Trump’s inauguration.

- Trump has proposed a heavy tariff on goods imported from Canada.

- US inflation data this week revealed soft underlying price pressures.

The USD/CAD weekly forecast points north as the Canadian dollar drops ahead of Trump’s inauguration.

Ups and downs of USD/CAD

The USD/CAD pair had a bullish week as the Canadian dollar weakened amid Trump tariff fears. Meanwhile, the dollar gained despite downbeat data due to the weak loonie.

-Are you interested in learning about forex tips? Click here for details-

Market participants were eagerly awaiting Trump’s inauguration and his policy changes. Notably, Trump has proposed a heavy tariff on goods imported from Canada, which will likely hurt the local economy. Therefore, the Bank of Canada would be under immense pressure to cut interest rates.

Meanwhile, inflation data this week revealed soft underlying price pressures, supporting bets for Fed rate cuts. At the same time, US sales came in below estimates, indicating easing consumer spending.

Next week’s key events for USD/CAD

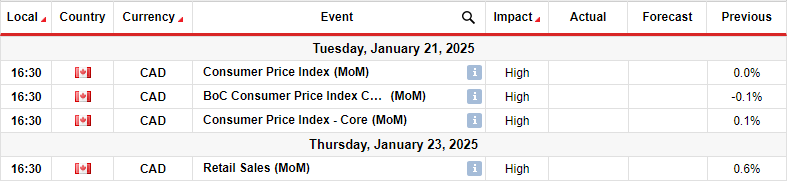

Next week, traders will focus on economic reports from Canada, including inflation and retail sales. The inflation report will show the state of price pressures in the country. Recent figures have shown a slowdown that has allowed the Bank of Canada to implement several rate cuts. A downbeat report would increase bets for rate cuts in 2025, weighing on the Canadian dollar.

The Bank of Canada in late 2024 shifted from focusing on inflation to growth. The economy was gradually declining amid high interest rates. The retail sales report will show the state of consumer spending, further shaping the outlook for BoC rate cuts.

USD/CAD weekly technical forecast: Bullish momentum targeting 1.4603

On the technical side, the USD/CAD price is bouncing higher after finding support at the 1.4300 key psychological level. The price trades above the 22-SMA, and the RSI is in bullish territory. Moreover, the price has made a series of higher highs and lows, suggesting a solid bullish trend.

-Are you interested in learning about the forex basics? Click here for details-

However, after breaking above the 1.4300 key level, the price traded in a tight consolidation as the SMA caught up. Meanwhile, the RSI made lower highs, indicating fading bullish momentum, which allowed bears to puncture the SMA line. However, bulls returned with renewed momentum and pushed the price back above the SMA.

If bullish momentum remains strong in the coming week, the price will likely retest the 1.4603 key level. This will mean a higher high and a continuation of the bullish trend.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.