European and US carmakers must strengthen supply chains and shorten four- to five-year product cycles to remain competitive.

NEWFOUNDLAND, Canada, Feb 12, 2025 – Carmakers in the US and Europe need to adjust product development timelines to compete with China. This is according to CoLab, a technology company building collaborative design review and AI solutions for hardware engineering teams, already working with big automotive manufacturers including Ford and Schaeffler.

Data from the European Automobile Manufacturers Association (ACEA) shows that output from European carmakers has remained flat since 2010, decreasing slightly (1.5%) from 18.3 million to 18 million in 2023 and by up to 12% in the UK. This is in stark contrast to figures from International Organization of Motor Vehicle Manufacturers (OICA), which show Chinese carmakers increasing production by 105%, from 13.9 million to 28.5 million, during the same period.

Chinese carmakers are bolstered by fewer regulations, in-house capabilities, and government support for supply chains, factors that enable the acceleration of product design timelines. Product development times for lead European and US carmakers like Volkswagen and Renault have historically been between 200-216 weeks, while Chinese rivals like NIO work to approximately 120 week timelines, getting new designs out to market in nearly half the time.

As US carmakers brace for further challenges, with tariffs introduced on goods from Canada, Mexico and China, the focus must be on building supply chain resilience:

“China controls critical resources for EV components,” explains Stephen Gibson, head of product development for Autoneum. “To stay ahead, or indeed catch up, we need to accelerate innovation, optimize costs, diversify supply chains, and leverage heritage and quality for differentiation. The competition is heating up,” concludes Gibson. “It is disruptive and it will help us to ultimately progress faster.”

Businesses can start accelerating innovation and optimizing costs at the design stage, without compromising on quality, by updating the request for quote (RFQ) process and by introducing co-design processes early on.

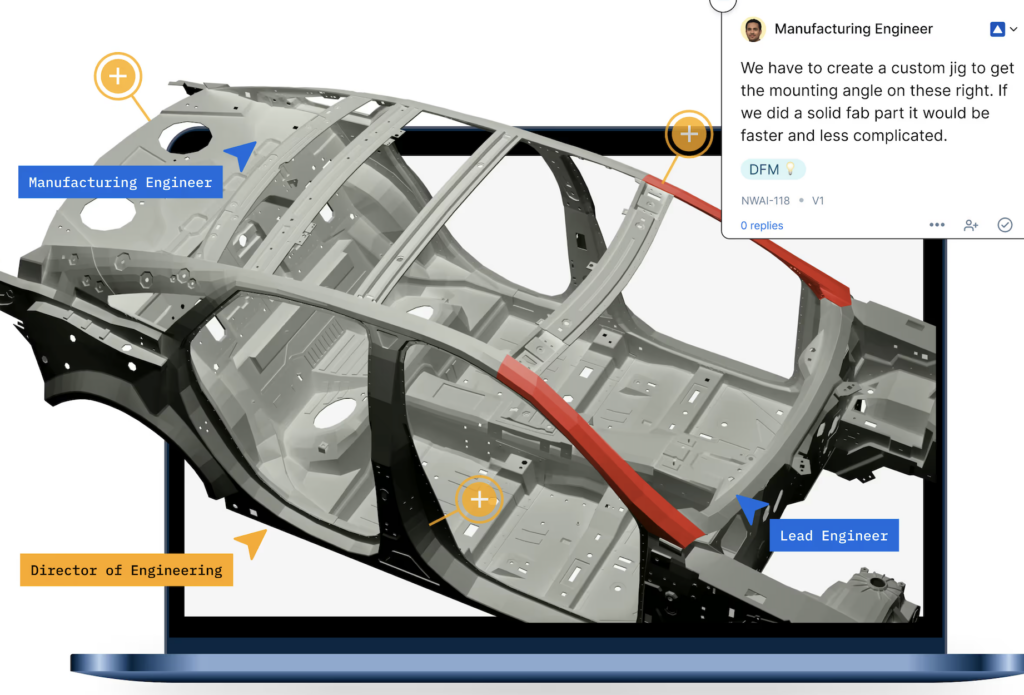

“Engineering-led supplier co-design is an easy way to build supply chain resilience,” says Adam Keating, co-founder and CEO of CoLab. “Today OEMs send out an RFQ, wait for a response, and then share product data with preferred partners only when the design is finished. Instead, OEMs can bring suppliers into design when the CAD is evolving. Leveraging modern digital tools, like CoLab Portals, engineers and suppliers do collaborative tech reviews during RFQs to accelerate and remove admin from that process. This allows them to design together in parallel and adapt to changes in real-time. This is engineering-led supplier co-design and it’s the simplest way for OEMs and suppliers to develop products concurrently while avoiding costly late-stage changes.”

“Now, the OEM wins because they benefit from a smoother, faster design process. Suppliers win because they have a competitive advantage in future RFQs. And both win by collaborating rather than reacting.” Keating continues, “The companies who adapt to this new way of supply chain collaboration see 30-50% faster lead times, 2x faster design cycles and up to 50% reduction in BOM costs.”

“The OEM wins, too,” Keating continues, “because by making these changes, engineering teams can cycle through product design iterations daily or weekly, cutting product design times in half. This is also very useful when it comes to redesigning parts. We’re seeing redesigns that cut bill of material (BOM) costs by 30% or more.”

Despite a slow-down in sales and production in 2024, due to reductions in subsidies and strategic planning by manufacturers with stricter emissions rules on the horizon, Europe is set to launch 160 new EV models in 2025. But to match Chinese options, these models need to be price competitive and exceed consumer expectations.

“The EV race has been going on for nearly five years, which means companies going to market with models now are already very late,” explains Keating. “Success will hinge on the ability to be nimble, on simple platforms and on the strength of the ecosystems carmakers build.”

“The pace of innovation also means that some EVs are out of date by the time they hit the market, “ continues Keating, “product delays and missed milestones can cost millions of dollars, which carmakers cannot afford in a market that is already seeing widespread discounting. Traditional carmakers will need to double product design speeds and eliminate typical four to five year product cycles, or risk collapse.”

Developments in AI can support carmakers to achieve this critical step change in speed and agility. Alongside new collaborative software like design engagement systems (DES) and existing CAD platforms, design reviews can be streamlined, automated and collaborative. Key partners can work in a closed environment, accessing only specific product data, but in parallel to in-house teams.

DES technology has already been proven to accelerate lead times by 30% for carmakers and enable revenue to be realized months earlier:

“It’s a massive increase in speed,” says Andrew Walden, senior project engineer at Ford Pro Special Vehicles. “We’ve rolled out CoLab to our entire 200-strong convertor network in Europe to accelerate design iterations and drive more innovative solutions,” Walden continues. “Now the converters can see the vehicle sooner, so they can get Ford products into the market quicker and help us be more competitive as a company.”

For more information, visit colabsoftware.com.