Learn how to avoid payment delays with effective invoice tracking. Discover tips, best practices, & tools to streamline your invoicing process for timely payments.

Managing cash flow is tough enough, even for organized businesses, without late payments. Automation simplifies invoice tracking, reduces admin work, boosts productivity, stabilizes cash flow, and cuts unpaid invoices.

This blog explores how efficient tracking helps organizations manage receivables, avoid delays, and strengthen client relationships.

Late payments can create a domino effect of stress-inducing uphill battles for organizations, impacting everything from daily operations to growth and profitability. With efficient and reliable invoice tracker automation, you can streamline payment and invoicing workflows without overloading your administration.

Below, we’ll break down specific challenges small businesses face with overdue invoices and the consequences of missed or overdue invoices.

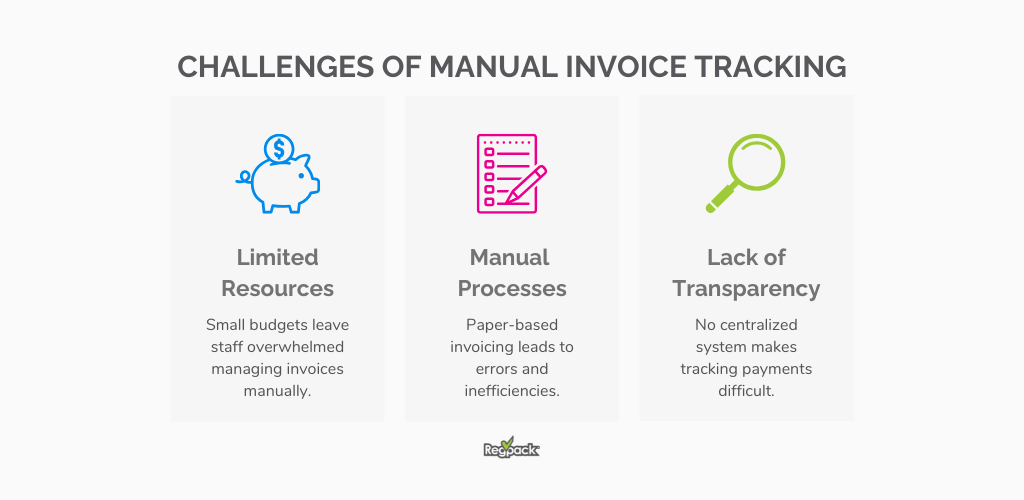

Challenges of Tracking Invoices for Small Businesses

Tracking invoices might seem straightforward, but when you start to cross the T’s and dot the I’s, the process becomes time-consuming, especially if your business lacks the resources to lighten the workload.

Understanding these obstacles, like manual processes or lack of visibility, is the first step in shifting your invoicing process from an exhausting task list to automated efficiency.

Limited Resources

Small businesses often need more money for a dedicated accounting team or automated invoice software, leaving admin staff overwhelmed by managing AP and cash flow.

Manual Processes

Relying on manual or paper-based invoicing increases the risk of errors and inefficiencies, potentially jeopardizing financial stability and supplier relationships.

Lack of Transparency

Without centralized invoicing software, tracking unpaid or late invoices and prioritizing follow-ups becomes a significant challenge.

Consequences of Overdue Invoices

Missed or overdue invoices aren’t just a temporary inconvenience—they can have a lasting effect that can substantially reduce growth, disrupt cash flow, and strain client relationships.

Cash Flow Hiccups

Late or forgotten payments make it hard to maintain essential operational costs like payroll, inventory, and rent. One or two missed payments are enough to create a financial crunch for business owners.

Strained Client Relationships

Chasing overdue payments puts an awkward strain on client conversation, potentially leading to damaged trust or churn. Additional late fees or penalties can stack up and replace part of the lost revenue. However, this can deter repeat businesses.

Growth Limitations

Small businesses need more capital or cash cushion to help cover operational costs or additional needs. Forgetting to chase a few payments significantly impacts sustainability and growth and can tighten your budget.

How Proper Invoice Management Prevents Financial Problems

Effective invoice management is a strategic tool for financial stability and growth. Streamlining and automating invoicing helps minimize late payments and improve cash flow.

Here’s how proper invoicing management safeguards your bottom line.

Improved Cash Flow

Invoices sent through automated workflows are sent promptly, reminders are scheduled, and follow-ups happen consistently based on account. The lack of human interference decreases the chances of overdue payments.

Increased Efficiency

Using automation, business owners can easily track dates, payment status, and client histories at the snap of a finger. Invoicing in a centralized system frees your administrative team to work on other essential tasks.

Stronger Client Relationships

Effective, proactive, and professional invoicing reduces misunderstandings and creates a secure and reliable payment process, enhancing client trust and satisfaction.

Common Causes of Payment Delays

Many businesses experience payment delays or lost invoices, but understanding and actively adapting to the root cause of unpaid invoices can help prevent them. Addressing payment issues early is crucial for small businesses aiming to grow.

Losing Track of Invoices

Tracking invoices through manual or outdated methods can cause problems in your payment workflows. Without a proper, unified system, follow-ups can be delayed, and overdue invoices can be overlooked.

Client Miscommunication

Misaligned information about payment terms, due dates, or invoice details can stop an invoice payment right in its’ tracks. For example, if a client misunderstands the dates on payment installment plans, the result is a late or disputed invoice. Transparent communication from start to finish is key to avoiding misunderstandings.

Errors in the Invoicing Process

Collecting payments incorrectly, missing line items or disorganized client details can lead to invoicing delays or disputes. Regardless of the size, payment corrections are time-consuming and often require back-and-forth communication to resolve the issue.

Missing Invoice Numbers or Details Invoices

Missing critical details– like invoice numbers, due dates, payment installment details, or terms – can confuse clients and increase the likelihood of delayed payments.

Clarification may be required before a client feels comfortable processing, which adds to the delay.

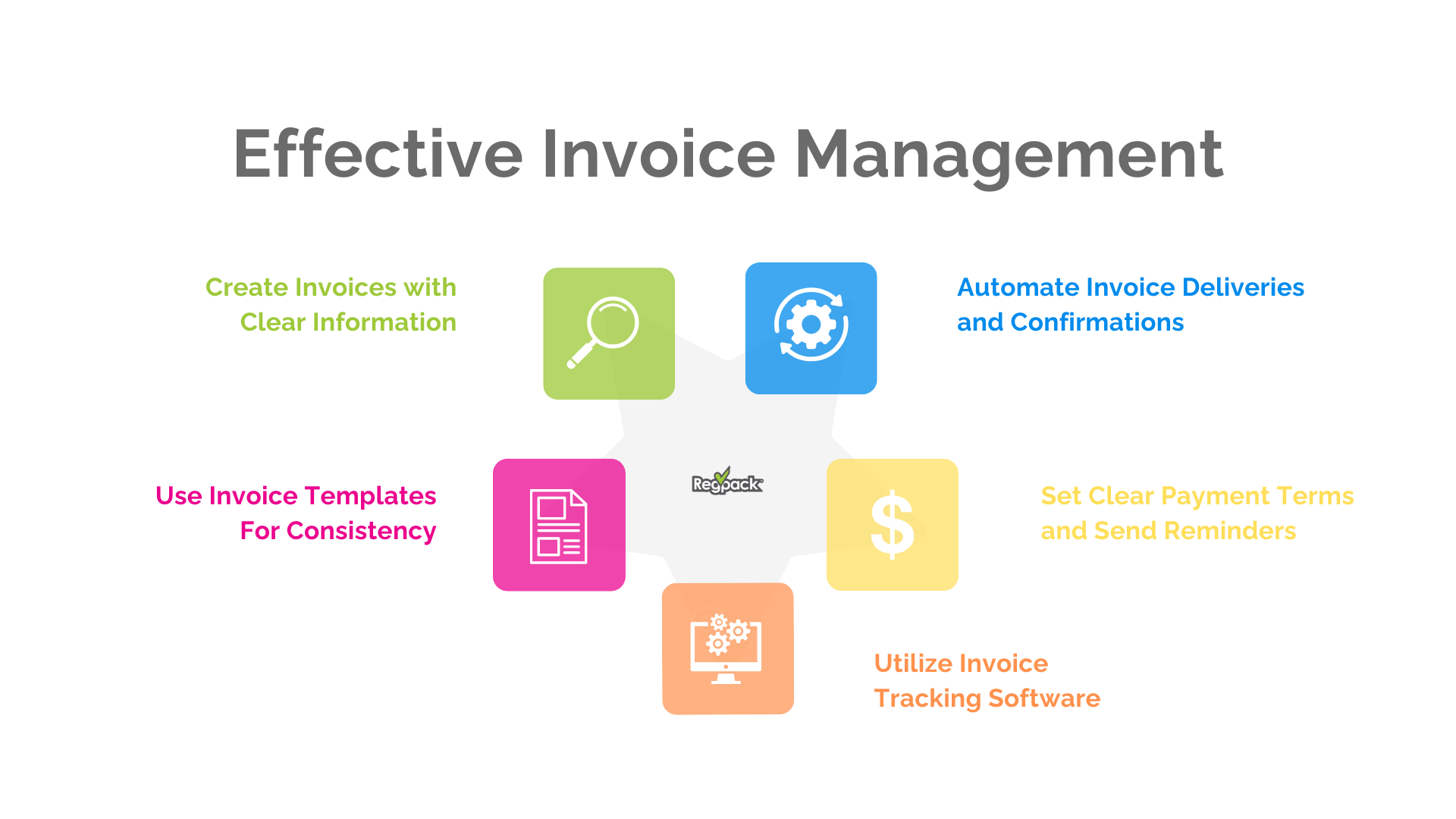

Best Practices for Effective Invoice Management

Efficient invoice management maintains streamlined operations and avoids payment-related curve balls. Implementing the following best practices can help businesses smooth out their invoicing processes.

Create Professional Invoices with Clear Information

A simple, well-crafted invoice minimizes confusion and ensures you’ll receive payments faster. Be sure to include these essential details.

- Invoice Number: Unique identifiers to accurately track each invoice

- Purchase Order (PO) Number: References client orders for accuracy

- Clear Payment Terms: Lockdown due dates and accepted payment methods, including installment plans and late fee policies if applicable.

Not only do professional invoices amplify your credibility, but they also simplify the payment process for clients.

Use Invoice Templates For Consistency

Using consistent and standardized templates promotes brand recognition and ensures invoices are error-free and professional. Crafting templates ahead of time reduces manual mistakes and frees up administrative hours.

Automate Invoice Deliveries and Confirmations

Advanced automation can eliminate time delays when sending invoices. Use software to:

- Automatically deliver invoices to all clients via email

- Send confirmation emails to ensure clients receive the proper invoice

Automation streamlines the process and guarantees invoices are always noticed.

Set Clear Payment Terms and Send Reminders

Define payment terms upfront, including:

- Due dates

- Payment methods

- Late fees or penalties

Timely reminders for outstanding invoices keep consistent, documented communication to keep clients accountable and shorten delays.

Utilize Invoice Tracking Software

Invoice tracking software is a groundbreaking and essential team member. For a small business, time is limited; an invoice software solution automates invoice organization, manages tracking numbers, and eliminates human error.

How Invoice Tracking Software Can Eliminate Payment Delays

From simplifying financial management to providing real-time data updates on your invoices, automated invoice tracking takes the responsibility out of your hands. Here’s how it helps:

- Real-Time Tracking: Keep an eye on the status of every invoice– whether it’s paid, sent, or pending– at the drop of a hat.

- Aging Reports: Auto-generate reports to aid in identifying overdue invoices and prompt follow-ups

- Integration with Accounting Software: Reduce missed payments by integrating with accounting tools that check every last detail, ensuring nothing slips through the cracks

These tools allow small businesses to take complete control of their payment processes and invoice workflows, reducing payment delays.

Key Features To Look for in an Invoice Tracking System

When choosing your ideal invoice tracking system, look for these features:

- Real-time Status Updates: Monitor invoice progress from start to finish

- Comprehensive Reporting: Generate real-time reports on outstanding invoice amounts or invoice volumes

- Unified Tracking: Track client and supplier invoices with one software

- Customizable Invoices: Create invoice templates that match your brand

- Auto Follow-Up Tracking: Log reminders, emails, and phone calls for easy tracking.

Strategies To Improve Invoice Delivery and Communication with Clients

Strong communication is the cornerstone of ensuring timely payments.

- Use Professional and Detailed Invoices: Keep invoices clear and itemized for client clarity.

- Prompt Follow-Ups: Send follow-up emails soon after the initial invoice delivery to confirm receipt and answer any questions

- Regular Communication: A quick phone call can resolve or prevent possible payment delays

- Email Reminders: Automated email reminders keep clients informed about upcoming or overdue payments

Achieve Timely Payments With Effective Innovation

Effective invoice management ensures reliable cash flow and improved client satisfaction. Using the right tools and practices, businesses can automate their invoicing, reducing errors and avoiding the stress of management invoicing and handling payment delays.

Regpack offers an all-in-one solution for managing payment processes and invoices with features like:

- Automated Billing: Simplify recurring payments

- Real-time Invoice Tracking: Always know the status of your invoices

- Customizable Invoicing Processes: Tailor invoices and payment workflows to fit your needs

Discover how Regpack can help your business improve cash flow, enhance client happiness, and achieve consistent, timely payments.

Ready to streamline your invoicing process?

Learn more about Regpack’s invoicing tracking and management solutions today!