- The gold outlook remains positive with a range-bound behavior.

- Trade tariffs and growth concerns boost the metal.

- The Fed’s hawkishness could limit the gains.

The gold outlook does not show a strong conviction to sustain the rally as markets remain unclear. Monday’s Asian session gave a little strength to the precious metal as US trade tariff jitters and global growth remain a key concern. Additional trade restrictions could further dampen the risk sentiment, eventually boosting the yellow metal.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

Besides trade tariffs, the weaker US dollar further bolsters gold’s demand. The greenback hit its lowest level since December 10 due to recent downbeat data. The dismal US PMI data signalled a slowdown in business activity. Moreover, Michigan Consumer Sentiment fell to 15-month lows, reflecting a growth concern.

Despite the factors supporting gold prices, the upside could be limited due to the Fed’s restrictive stance for an extended period. The recent FOMC meeting minutes reflected a hawkish tone from the policymakers, who said they were not hurrying to cut rates. Hence, yields are expected to stay elevated, and gold’s rally will be limited.

Market participants await Core PCE Index data, a preferred inflation gauge for the Fed. A higher number could further strengthen the case of a hawkish Fed. Moreover, US GDP for the fourth quarter will also be important to watch. Upbeat data may trigger a sell-off in the gold.

Key Events to Watch Today

There is no major event for today. Hence, price will likely be dominated by the risk sentiment and technical levels.

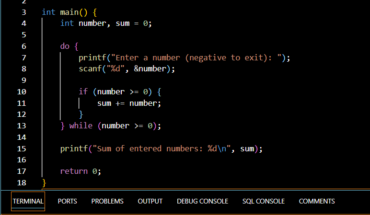

Gold Technical Outlook: Ranging before a breakout

The gold price remains range-bound near its all-time highs. Though the price retreated briefly, the technical outlook remains unchanged. The 30-period SMA on the 4-hour chart shows a strong uptrend while the RSI level hits 50.0, reverses, and is well below the overbought area, indicating a potential rally to $3,000.

-Are you looking for the best CFD broker? Check our detailed guide-

On the flip side, the demand zone appears in the $2,865-85 region. Before testing the zone, there are some tough support levels at $2,915 and $2,900.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.