- Republican candidate Donald Trump won the US presidential election.

- The Bank of England cut interest rates by 25-bps as expected.

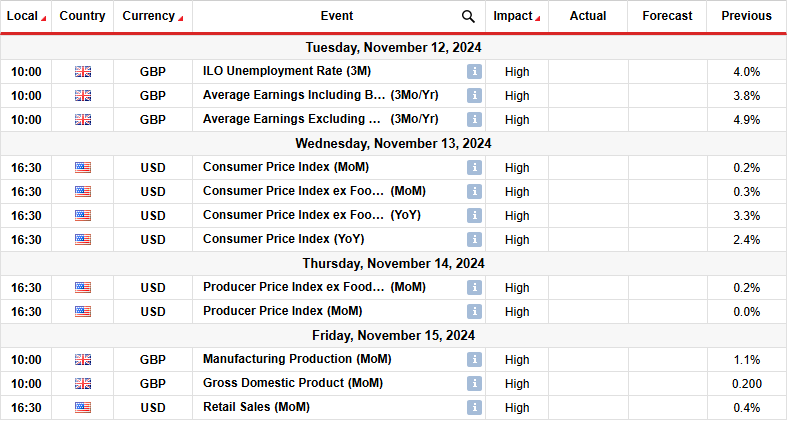

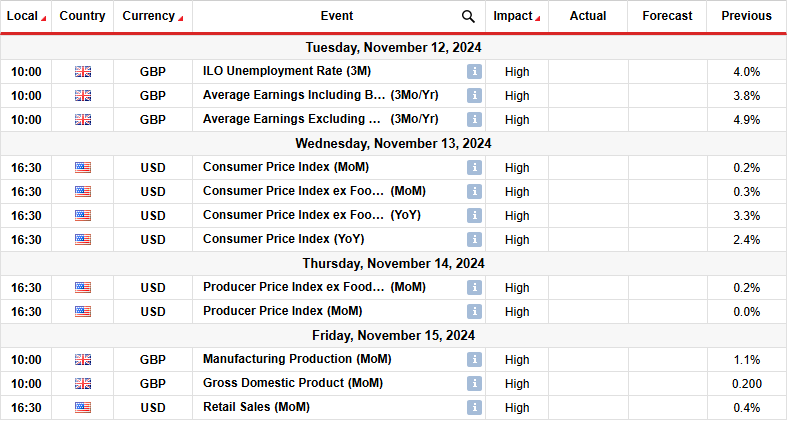

- Next week, the US will release consumer and wholesale inflation data.

The GBP/USD weekly forecast points south amid a drop in BoE rate cut expectations and a stronger dollar after Trump’s win.

Ups and downs of GBP/USD

After a volatile week, the pound ended on a bearish candle as market participants absorbed the US election results. After weeks of uncertainty, Republican candidate Donald Trump won the election. The win was bullish for the greenback because of the expectation of higher tariffs and tax cuts during Trump’s presidency.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

Meanwhile, the Bank of England cut interest rates by 25-bps as expected. However, the pound rallied as policymakers noted that the new budget would likely increase inflation more than earlier expected. As a result, traders reduced the expected rate cuts in 2025 from four to three or two.

Next week’s key events for GBP/USD

Next week, the UK will release crucial employment figures shaping the outlook for Bank of England rate cuts. Already, economists do not expect another BoE rate cut this year. Robust employment figures will likely push back the timing of the next rate cut.

At the same time, traders will focus on data on manufacturing production and gross domestic product that will show the state of the UK economy. Recent data has demonstrated better-than-expected economic performance, which has lowered the expected rate cuts.

Meanwhile, the US will release consumer and wholesale inflation data that will determine the Fed’s future policy moves. If inflation is higher than forecast, the US central bank might hesitate to cut in December. On the other hand, rate cut expectations will surge on cooler-than-expected figures.

GBP/USD weekly technical forecast: Bears target the 1.2701 support

On the technical side, the GBP/USD price has collapsed further to make a new low below the 1.3000 key psychological level. At the same time, the price trades below the 22-SMA with the RSI in the bearish region below 50.

–Are you interested in learning more about AI trading brokers? Check our detailed guide-

After bulls paused at the 1.3400 resistance, bearish momentum surged, prompting the price to break below its support trendline and the 22-SMA. Therefore, control shifted from bulls to bears and has remained that way. At some point, bulls challenged the SMA and the 1.3000 but were not strong enough to take charge. Consequently, the coming week might see GBP/USD reaching the 1.2701.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.