- The Fed held rates during its policy meeting.

- Trump renewed his threats to impose tariffs on Mexico and Canada.

- The BoE will likely cut interest rates next week.

The GBP/USD weekly forecast shows a looming Bank of England rate cut that will likely push the pound lower.

Ups and downs of GBP/USD

The GBP/USD pair had a slightly bearish week as the dollar strengthened and the pound fell ahead of a BoE rate cut. The greenback gained after the Fed held rates during its policy meeting and signaled no rush to lower borrowing costs. At the same time, Trump renewed his threats to impose tariffs on Mexico and Canada, boosting the US currency.

Meanwhile, market participants looked forward to next week’s BoE policy meeting. The central bank will likely cut interest rates, weighing on the pound.

Next week’s key events for GBP/USD

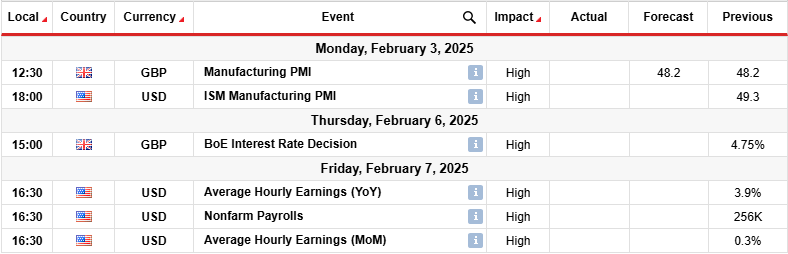

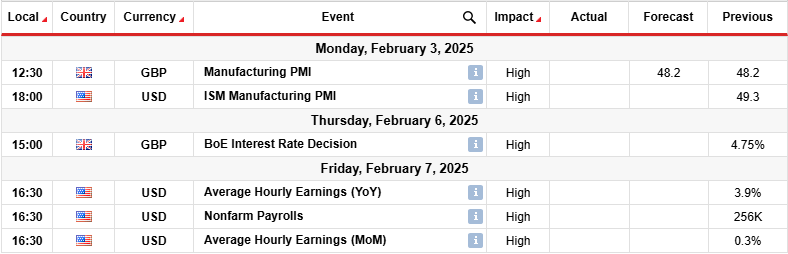

Next week, market participants will focus on manufacturing business activity data from the US and the UK. Traders will also watch the Bank of England policy meeting on Thursday. Finally, the US will release its crucial monthly employment report.

Economists expect the Bank of England to lower borrowing costs by 25-bps on Thursday. At the same time, markets will wait to see whether policymakers project more rate cuts for this year. The UK economy has slowed down significantly, piling pressure on the central bank to cut interest rates.

Meanwhile, the US nonfarm payrolls report will show whether the labor market remains resilient. An upbeat report will convince the Fed to keep rates elevated. On the other hand, softness will increase rate cut expectations, weighing on the dollar.

GBP/USD weekly technical forecast: Bulls trigger a channel breakout

On the technical side, the GBP/USD price has broken out of its bearish channel with a solid bullish candle. At the same time, the price broke above the 22-SMA, indicating a bullish shift in sentiment. Meanwhile, the RSI trades slightly below 50, showing that bearish momentum remains.

-If you are interested in knowing about scalping forex brokers, then read our guidelines to get started-

The breakout comes after bears met a solid hurdle at the 1.2203 support level. Initially, the price had maintained a strong downtrend. However, the price kept puncturing the SMA resistance, showing bulls were not so weak.

Moreover, the RSI failed to dip into the oversold region during the decline, showing bears were holding back. Bulls eventually overpowered bears at the 1.2203 support. The price will break above 1.2550 next week if they remain in the lead.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.