- ECB’s Isabel Schnabel said on Wednesday that the central bank should cut rates gradually.

- Market participants are anticipating the German inflation report.

- US inflation increased by 0.3%.

The EUR/USD outlook shows a slight pullback following a sharp bullish turn after hawkish European Central Bank remarks boosted the euro. However, trading remained thin as the US observed the Thanksgiving holiday.

–Are you interested to learn more about forex options trading? Check our detailed guide-

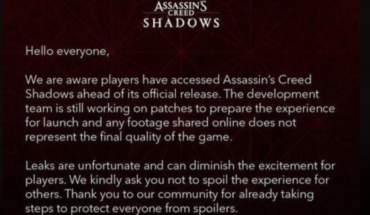

ECB’s Isabel Schnabel said on Wednesday that the central bank should cut rates gradually and not aggressively. According to her, lowering borrowing costs to spur economic growth will not solve the Eurozone’s deep structural issues. Moreover, Isabel added that she did not see a recession in the future, giving the central bank enough room to hold rates at restrictive levels.

Meanwhile, market participants are anticipating the German inflation report, which will give more clues on ECB rate cuts. Markets expect policymakers to cut rates at the next few meetings in order to support the fragile economy.

On the other hand, the greenback remained frail after economic data in the previous session solidified bets for a December Fed rate cut. The core PCE inflation report revealed that inflation increased by 0.3%, meeting forecasts. Meanwhile, the US economy expanded by 2.8% as expected. A separate report showed that initial jobless claims eased slightly from 215,000 to 213,000.

The dollar had initially rallied after Trump promised to impose tariffs on China, Canada, and Mexico. Market participants are looking forward to Trump’s new administration, which will take office in January. The looming policy changes threaten to shift the outlook for economic growth, inflation, and monetary policy. While these changes will likely support the dollar, they might hurt the Eurozone economy and the euro.

EUR/USD key events today

EUR/USD technical outlook: Bulls take control above 1.0500 key level

On the technical side, the EUR/USD price has broken above the 1.0500 key level and the 30-SMA, showing a bullish reversal. At the same time, the RSI now trades above 50, indicating strong bullish momentum.

–Are you interested in learning more about scalping forex brokers? Check our detailed guide-

After consolidating below the SMA, the price has finally broken above with strong candles. However, it is currently pulling back to retest the 30-SMA and the 1.0500 level as support. If bulls remain in the lead, the price will bounce high and aim for the 1.0700 resistance level. Otherwise, it will break back below the SMA to target the 1.0301 support level.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.