- The euro dropped on Monday due to dovish comments from a top ECB official.

- Eurozone business activity improved in December.

- The dollar extended its gains as markets anticipated a more cautious Fed.

The EUR/USD forecast shows a surge in European Central Bank rate cut bets after dovish policymaker remarks. Meanwhile, PMI data showed a slight rebound in the Eurozone economy. However, business activity remained in contraction, showing a frail economy.

–Are you interested to learn more about forex options trading? Check our detailed guide-

The euro dropped on Monday due to dovish comments from a top ECB official. ECB Vice President Luis De Guindos said that inflation in the Eurozone bloc would likely hold at the 2% target in 2025. Moreover, he noted that the central bank will continue cutting rates if inflation meets forecasts.

The European Central Bank lowered borrowing costs by 25-bps on Thursday. At the same time, policymakers remained dovish, forecasting more cuts due to the weak economy and uncertainty about likely tariffs in the US. Such an outlook will likely weigh on the euro, especially since it diverges with the US outlook.

Furthermore, data on Monday revealed that business activity in the Eurozone improved in December due to growth in the services sector. Notably, the flash composite PMI increased from 48.3 in November to 49.5 in December. Meanwhile, economists had expected a drop to 48.2. However, business activity remains in contraction below 50.

Elsewhere, the dollar extended its gains as markets anticipated a more cautious Fed in the coming year. Nevertheless, traders have fully priced a rate cut this week. Meanwhile, the likelihood of a January cut remains low at 24%.

EUR/USD key events today

- US flash manufacturing PMI

- US flash services PMI

EUR/USD technical forecast: Bears make another attempt at 1.0475 support

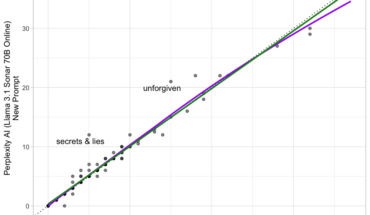

On the technical side, the EUR/USD price is bouncing lower after finding a strong barrier at the 30-SMA. Meanwhile, the RSI trades below 50, suggesting solid bearish momentum. However, bears have found it difficult to break below the 1.0475 support, which coincides with the 0.5 Fib retracement level.

–Are you interested to learn more about forex tools? Check our detailed guide-

A break below this zone would allow the price to make lower lows and reach the 1.0400 key support level. Such an outcome would signal a new downtrend. On the other hand, if the support zone holds firm, the price might break above the SMA to retest the 1.0601 resistance level. However, bulls would have to break above this resistance to confirm a new bullish trend.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.