- The dollar climbed earlier in the week when tensions between Russia and Ukraine escalated.

- The Trump trade paused as traders awaited new developments.

- The Reserve Bank of Australia maintained its hawkish tone.

The AUD/USD weekly forecast shows a slight rebound as the RBA remains hawkish, but the pair still has downside potential.

Ups and downs of AUD/USD

The Aussie rebounded this week as the dollar paused its Trump rally and the RBA maintained a hawkish. The greenback paused this week after a strong rally due to Trump’s win. However, it climbed earlier in the week when tensions between Russia and Ukraine escalated.

Meanwhile, the Trump trade paused as traders awaited new developments. US data showed an unexpected decline in jobless claims, lowering the likelihood of a December Fed rate cut.

Elsewhere, the Reserve Bank of Australia maintained its hawkish tone, stating there was no hurry to lower rates as they were not as high as in other major economies.

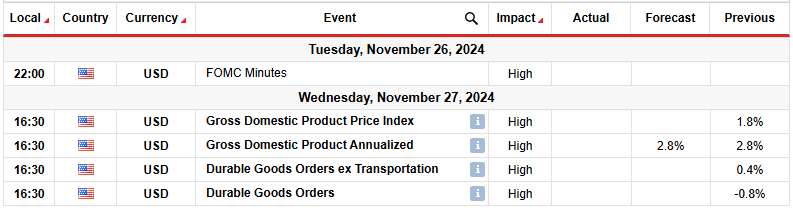

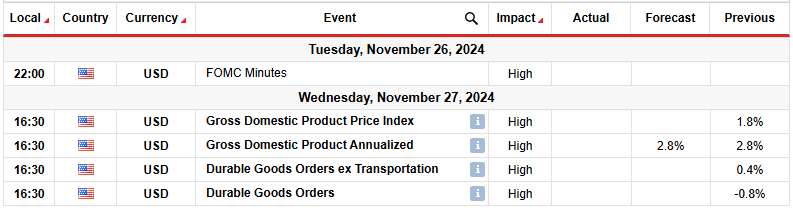

Next week’s key events for AUD/USD

Next week, investors will focus on reports from the US, including the Fed minutes, GDP, and durable goods orders. The FOMC meeting minutes will have a comprehensive report of the last policy meeting, which might contain clues on what policymakers intend to do in the future. The meeting came right after Trump won the US presidential election, changing the outlook for US economic growth and inflation. Consequently, market participants will wait to see if this changed policymakers” tone.

Meanwhile, the GDP report will show the health of the economy. Economists expect a 2.8% increase after a similar reading last month.

AUD/USD weekly technical forecast: RSI divergence prompts pullback

On the technical side, the AUD/USD price is in a downtrend, consistently making lower highs and lows. Moreover, the price trades below the 22-SMA with the RSI under 50, supporting a bearish bias. The downtrend has paused at the 0.6450 critical level after breaking below the 0.6550 support. The pause has allowed bulls to revisit the recently broken support zone.

–Are you interested in learning more about scalping forex brokers? Check our detailed guide-

The pullback might continue to the 22-SMA in the coming week before bears resume the downtrend. To confirm a continuation of the downtrend, the price must break below 0.6450 to make a new low. However, the RSI has made a slight bullish divergence that could signal a reversal. Nevertheless, bulls must break above the SMA to confirm a reversal. Otherwise, the downtrend will continue.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.