- Inflation increased by 0.1%, lower than the forecast of 0.2%.

- Market participants have adjusted to a more gradual outlook for the Fed.

- Data from Canada showed retail sales increasing by 0.6%.

The USD/CAD forecast shows an extension of last week’s rally after a brief pause on Friday. The dollar eased as the week ended due to softer-than-expected US inflation figures. Meanwhile, the Canadian dollar resumed last week’s decline amid a divergence in policy outlooks between the Fed and the Bank of Canada.

-Are you looking for the best AI Trading Brokers? Check our detailed guide-

On Friday, the US core PCE price index report revealed that inflation increased by 0.1%, lower than the forecast of 0.2%. As a result, the greenback eased after a strong week. The softer figures rekindled hopes that inflation would reach the Fed’s target. However, it was not enough to change the outlook for rate cuts in 2025.

Last week, the Federal Reserve lowered borrowing costs and forecasted fewer rate cuts in 2025. As a result, market rate cut bets plunged, boosting the dollar and weighing on the Canadian dollar. Market participants have adjusted to a more gradual outlook for the Fed.

On the other hand, the Bank of Canada has maintained an aggressive pace to spur growth in the weak economy. Moreover, experts believe this will continue, given the likelihood of tariffs on Canadian exports to the US. Such an outcome would undo some of the BoC’s efforts to revive the economy. Consequently, it would put more pressure on the central bank to lower interest rates.

Elsewhere, Friday’s data from Canada showed retail sales increasing by 0.6%, below forecasts of 0.7%. Traders will now watch GDP data for more clues on the BoC’s rate-cut outlook.

USD/CAD key events today

USD/CAD technical forecast: Bulls reemerge at the 30-SMA support

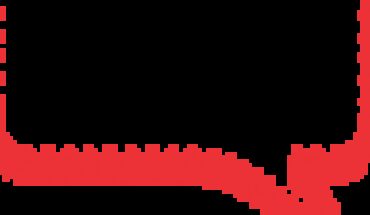

On the technical side, the USD/CAD price is bouncing higher after finding support at the 30-SMA. At the same time, the RSI has retested and is bouncing off the 50 level, separating the bullish and bearish territory. As a result, the bullish bias is strong, with the price above the 30-SMA and the RSI in bullish territory.

–Are you interested in learning more about Canadian forex brokers? Check our detailed guide-

Bulls are eyeing the 1.4450 resistance level, which was the previous high. A break above this level would make a higher high, continuing the bullish trend. The price would target higher resistance levels. However, if the level holds firm, the price might make a double top, signaling a looming bearish reversal.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.