- The fears of a looming French government collapse weighed on the euro.

- The dollar fell due to downbeat service business activity and unemployment claims data.

- The US unemployment rate rose to 4.2% in November.

The EUR/USD weekly forecast shows a recovery as French political turmoil eases and US unemployment surges.

Ups and downs of EUR/USD

The EUR/USD pair ended the week flat after fluctuating amid political developments in France and US economic data. The fears of a looming French government collapse weighed on the euro. However, the currency recovered when the actual collapse failed to have such a significant impact. French government bonds rebounded, boosting sentiment.

-If you are interested in Islamic forex brokers, check our detailed guide-

Meanwhile, the dollar initially fell due to downbeat service business activity and unemployment claims data. However, the NFP report revealed a surge in job growth, temporarily boating the dollar. Meanwhile, the unemployment rate rose to 4.2%, solidifying bets for a December Fed rate cut.

Next week’s key events for EUR/USD

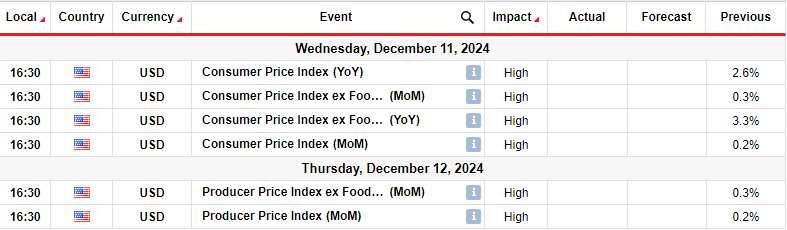

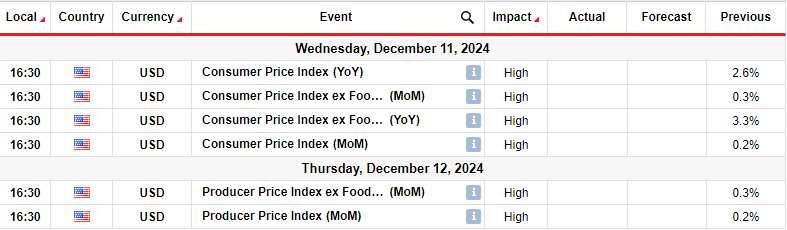

Next week, traders will watch US inflation figures for clues on Fed monetary policy. The Consumer Price Index is due on Wednesday. The last report showed inflation had stalled above the central bank’s target. However, December Fed rate cut expectations remained steady since inflation met expectations. This time, if inflation is higher than expected, it will reduce the likelihood of a December rate cut. On the other hand, if it meets forecasts or comes in below, rate-cut bets will surge, and the dollar will fall.

Meanwhile, the Producer Price Index, due on Thursday, will show price pressures at the producer level. The PPI is a leading indicator of future consumer prices. Therefore, a drop will support rate-cut bets, while an increase will boost the likelihood of a Fed pause.

EUR/USD weekly technical forecast: Rebound meets solid resistance zone

On the technical side, the EUR/USD price has pulled back to retest the 22-SMA resistance after meeting the 1.0400 support. Although it punctured the SMA, the bearish bias remains intact. The RSI trades below 50, suggesting strong bearish momentum.

-If you are interested in brokers with Nasdaq, check our detailed guide-

Moreover, bulls have punctured the SMA before and failed to reverse the trend. This has created a resistance trendline slightly above the SMA. A break above this trendline would signal a likely reversal. However, if bears remain in the lead, the price will bounce lower next week to retest the 1.0400 support level. A break below this level would continue the downtrend with a lower low.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.