- EUR/USD forecast remains neutral with no clear bias.

- Easing Fed’s dovishness keeps the US dollar strong.

- Market awaits impetus to break out of current range.

The EUR/USD forecast remains neutral for the day as the economic calendar is light and trading activity is thin. The pair attempted to gain some ground from Friday’s lows but failed to sustain the gains at 1.0570. The broader dollar strength overshadows the recovery in risk assets.

–Are you interested in learning more about Canadian forex brokers? Check our detailed guide-

Geopolitics has again taken center stage with renewed heat from the Russia-Ukraine crisis. Hence, the risk-off sentiment favors the US dollar and keeps pressure on the Euro. Moreover, the fear of a trade war between the European Union and the US has also deteriorated Euro’s outlook.

After Trump’s victory, market analysts have revised their forecast for the US dollar in 2025, expecting a sharp growth in the currency. Fed’s dovish bets have also eased as the rate cut path could be slowed down. Fed Chair Jerome Powell said he cannot predict Trump’s policy guidance on the future rate cuts. He also said that the economic indicators have not sent signals to ramp up rates. The inflation is slowly moving towards a sustainable 2% target that could help us attain a neutral rate.

Key Events to Watch

There is no significant event on the calendar today. However, the market participants may be looking for some fresh clues in today’s speech of ECB Chir Lagarde regarding monetary policy.

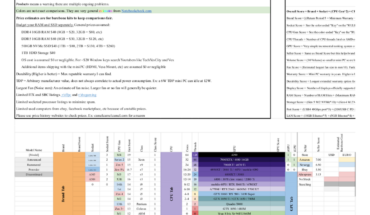

EUR/USD Technical Forecast: Rangebound behavior

The EUR/USD forecast remains elusive as buyers attempt to stay above the 1.0500 mark but fail to sustain the gains beyond 1.0570. The 4-hour chart shows the price remains in a tight range starting from Nov 13th. The pair is perhaps looking for a fresh impetus to break out of the range on either side.

–Are you interested in learning more about high leveraged brokers? Check our detailed guide-

The 30-SMA lies above the price, showing a sustained bearish momentum, while the RSI has moved up to 40.0 level which indicates the pair is out of oversold condition and the downside momentum may continue.

Technically, the pair needs acceptance above 1.0600 to initiate a bullish momentum, while breaking the 1.0500 mark may bring strong selling towards the 1.0450 area.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money