- Trump’s policies will likely boost economic growth and inflation.

- The Fed might be forced to keep rates at a restrictive level longer.

- The UK economy unexpectedly contracted.

The GBP/USD weekly forecast is bleak as the pound collapses against a strong dollar amid the Trump trade weaker UK GDP.

Ups and downs of GBP/USD

The GBP/USD pair had a very bearish week as the Trump trade boosted the dollar and weighed on the pound. Despite various economic reports from the UK and the US, markets were focused on the looming shift in policies in the US.

–Are you interested in learning more about Canadian forex brokers? Check our detailed guide-

Trump’s policies will likely boost economic growth and inflation. Therefore, the Fed might be forced to keep rates at a restrictive level longer. High interest rates boost Treasury yields and the greenback.

Meanwhile, US inflation data aligned with expectations, leaving rate-cut bets mostly unchanged. However, Powell’s remarks that there was no hurry to cut rates slashed bets to below 50%. On the other hand, the UK economy unexpectedly contracted, further weighing on the pound.

Next week’s key events for GBP/USD

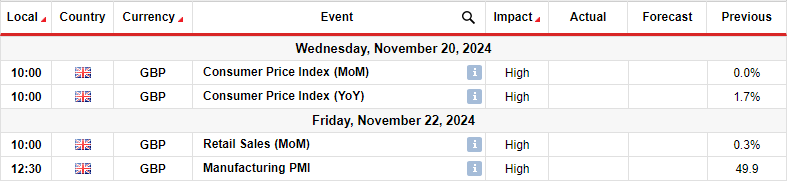

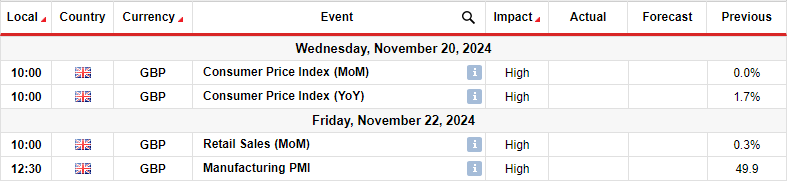

Next week, market participants will focus on key economic reports from the UK, including consumer inflation, retail sales, and business activity. Inflation in the UK recently dropped below the Bank of England’s target to hit 1.7%. The decline was initially a big motivator for the central bank to lower borrowing costs.

However, policymakers remained cautious, noting that the economy might perform better than expected in the medium term. Therefore, inflation might rebound. A better-than-expected CPI reading will lower rate-cut expectations and boost the pound. Meanwhile, a downbeat report will weigh on the currency.

GBP/USD weekly technical forecast: Decline could pause at 1.2600

On the technical side, the GBP/USD price has plunged to the 1.2600 support level. The new swing long has put the price well below the 22-SMA, showing bears are in the lead. At the same time, the RSI has reached the oversold region, suggesting solid bearish momentum.

–Are you interested in learning more about high leveraged brokers? Check our detailed guide-

This week, the GBP/USD price only made bearish candles, showing a strong bias. The decline started after the price broke below and retested the 1.3002 key level. At the same time, the price was retesting the 22-SMA as resistance. It bounced lower, breaching the 1.2801 support before pausing at the 1.2600 level. However, after such a steep decline, the price might need a pause next week before it continues lower.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money