- The GBP/USD weekly forecast shows a rebound in the pound.

- US Job growth slowed down slightly in February.

- The US unemployment rate increased from 4.0% to 4.1%.

The GBP/USD weekly forecast shows a rebound in the pound as the dollar drops amid soft NFP and tariff uncertainty.

Ups and downs of GBP/USD

The GBP/USD price had a bullish week as the pound soared against a weak dollar. The greenback collapsed as market participants grew fearful of a US economic slowdown. On Tuesday, Trump implemented tariffs on Canada, Mexico and China. Although he suspended some of these tariffs, traders worried that trade wars would hurt the US economy.

–Are you interested to learn more about forex options trading? Check our detailed guide-

Meanwhile, Fed rate cut expectations increased after US nonfarm payrolls came in lower than expected. Job growth slowed down slightly. At the same time, the unemployment rate increased from 4.0% to 4.1%. More downbeat data next week could push traders to start pricing three rate cuts this year.

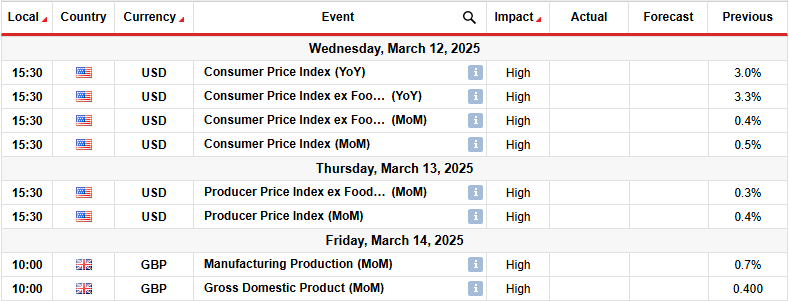

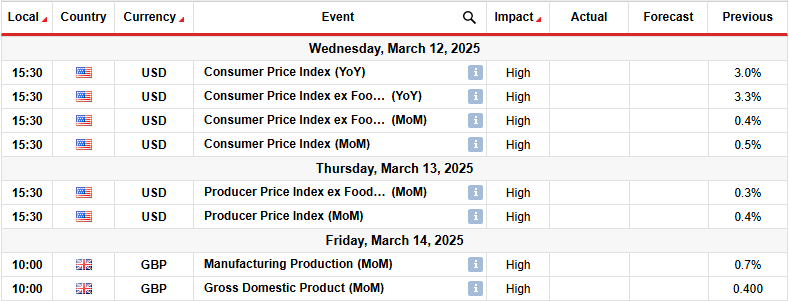

Next week’s key events for GBP/USD

Next week, the US will release its CPI and PPI reports, showing the state of inflation. Meanwhile, the UK will release data on manufacturing production and gross domestic product. The inflation data will shape the outlook for Fed rate cuts. Economists expect inflation to ease from the previous month. Such an outcome would align with recent data showing a slowdown in the US economy. Therefore, it would increase Fed rate cut expectations, boosting GBP/USD.

Meanwhile, UK data will show the health of the UK economy and shape the outlook for Bank of England monetary policy.

GBP/USD weekly technical forecast: Bulls meet the 0.618 Fib hurdle

On the technical side, the GBP/USD price has broken above the 1.2800 key resistance level. This move has pushed the price far above the 22-SMA, with the RSI in the overbought region, indicating solid bullish momentum.

–Are you interested to learn more about Thailand forex brokers? Check our detailed guide-

The price recently reversed after a strong downtrend. Since the reversal, bulls have maintained their position above the 22-SMA, constantly reaching new highs. However, the current high has fallen near the 0.618 Fib retracement level. This might act as a solid resistance. Therefore, GBP/USD might pull back to retest the recently broken 1.2800 key level. A deeper pullback would retest the 22-SMA.

However, as long as the price stays above the SMA and the RSI above 50, the bullish trend will continue. Therefore, GBP/USD might reach the 1.3201 resistance level.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.