- The EUR/USD weekly forecast shows an increasing chance of tariffs on Eurozone goods.

- Trump confirmed that the 25% tariff on Canada and Mexico would be effective in March.

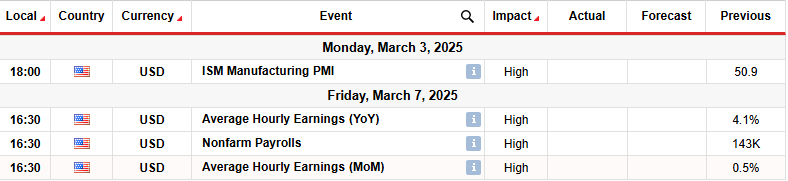

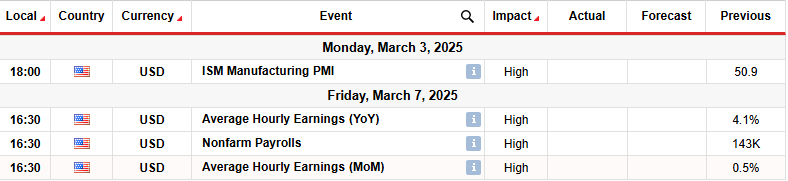

- Traders will watch US employment data next week.

The EUR/USD weekly forecast shows a growing likelihood of tariffs on Eurozone goods that would weigh on the euro.

Ups and downs of EUR/USD

The EUR/USD pair had a bullish week as traders focused on Trump’s trade policies. The week had few significant economic releases, putting all focus on Trump’s speeches. The US president caused concerns about the global economy when he confirmed that the 25% tariff on Canada and Mexico would be effective in March.

–Are you interested in learning more about making money with forex? Check our detailed guide-

Traders who had expected further delays to April panicked and rushed to the safe-haven dollar. Moreover, Trump threatened the Eurozone with a similar tariff.

Next week’s key events for EUR/USD

Next week, market participants will focus on data from the US, including business activity in the manufacturing sector and employment. Business activity in the manufacturing sector has rebounded in recent months. If this trend continues, it will indicate a resilient economy.

Meanwhile, the US nonfarm payrolls report will play a massive role in shaping the outlook for Fed rate cuts. In the previous month, job growth slowed slightly to 143,000. However, the unemployment rate also fell, showing the labor market remained resilient. Another upbeat report will lower expectations for Fed rate cuts. On the other hand, softness in the labor market could push traders to price three cuts this year.

EUR/USD weekly technical forecast: Bears set sights on 1.0200 support

On the technical side, the EUR/USD price is bouncing lower after meeting the 1.0500 key resistance level. At the same time, the price has broken below the 22-SMA, showing bears have taken the lead. Meanwhile, the RSI has broken below 50, indicating stronger bearish momentum.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

EUR/USD is in a corrective move after a steep downtrend. The price has paused to consolidate between the 1.0500 resistance and the 1.0200 support. Therefore, bears will likely retest the range support in the coming week. Meanwhile, the price would have to break below the range support to confirm a continuation of the previous downtrend. Such a move could clear the path to parity. On the other hand, if the support holds firm, the price might remain in consolidation for longer.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.