Managing payments for an event should be simple, not stressful. Whether you’re organizing a conference, fundraiser, or community gathering, having a smooth online payment process allows attendees to easily secure their spots while you focus on planning. But without the right payment system, you might run into delayed transactions, lost registrations, or unnecessary manual work.

Seamless event registration and payment platform not only speeds up the checkout process but also improves the overall payment experience for attendees. Accepting multiple payment methods, automating confirmation emails, and ensuring secure payments can make all the difference in running a successful event.

Why Efficient Online Payment System is Important for Event Success

A smooth payment process is crucial for any event, whether you’re selling tickets, accepting donations, or collecting fees for workshops. If your payment system is slow or complicated, potential attendees may abandon their registrations before completing their payment information.

Here’s why an efficient online payment solution matters:

- Faster Registration and Fewer Drop-offs: A thorough payment system simplifies the checkout process, encouraging more people to complete their ticket sale without second-guessing.

- Better Attendee Experience: Providing multiple payment options, such as credit card, debit card, or direct transfers from a bank account, allows there to be convenience for everyone.

- Automated Tracking and Reporting: With the right event management software, you can track ticket sales, monitor revenue in real time, and generate financial reports effortlessly.

- Compliance with Tax Regulations: If your event qualifies as a taxable service., integrating the correct tax rate for your local jurisdiction ensures compliance and prevents issues with sales tax.

- Secure and Reliable Transactions: A trusted payment gateway protects sensitive personal information, reducing fraud risks and ensuring every secure payment is processed correctly.

Investing in a reliable registration software with built-in payment processing not only makes your job easier but also improves the experience for attendees, increasing registrations and revenue.

Common Payment Collection Mistakes and How to Avoid Them

Managing event payments can be straightforward if you use the right tools, but there are still common mistakes many organizers make. Here are some of the most frequent payment collection mistakes and how to avoid them:

Not Offering Multiple Payment Options

Limiting your payment methods can result in missed opportunities. If your system only accepts credit card payments, you’re excluding attendees who prefer to use debit cards or other payment methods like ACH transfers. By offering a variety of payment options, you ensure that all attendees can easily register and complete their ticket sale.

Failing to Track Payments in Real-Time

Without real-time payment processing, it’s easy to lose track of who has paid and who hasn’t. This can lead to confusion and make it difficult to manage finances. Tracking payments as they come in allows you to address issues promptly and avoid mistakes down the line.

Ignoring Sales Tax Compliance

If your event qualifies as a taxable service, failing to properly calculate and collect sales tax can result in compliance issues. Different local jurisdictions may have different tax rates, so it’s essential to have a system in place that automatically handles tax calculations based on the rate in your area. This ensures you’re always in compliance with local tax laws.

Not Having Clear Refund and Cancellation Policies

Refund policies are often overlooked, but they are important for managing attendee expectations. Whether you offer partial refunds or full cancellations, make sure your policy is clear and communicated upfront during the registration process. This avoids misunderstandings and reduces the chances of conflict after the event.

Overcomplicating the Payment Process

To avoid attendees from abandoning their registrations keep the process as simple as possible by using a payment platform with straightforward forms. A streamlined, user-friendly system guarantees that attendees can quickly and easily complete their payments.

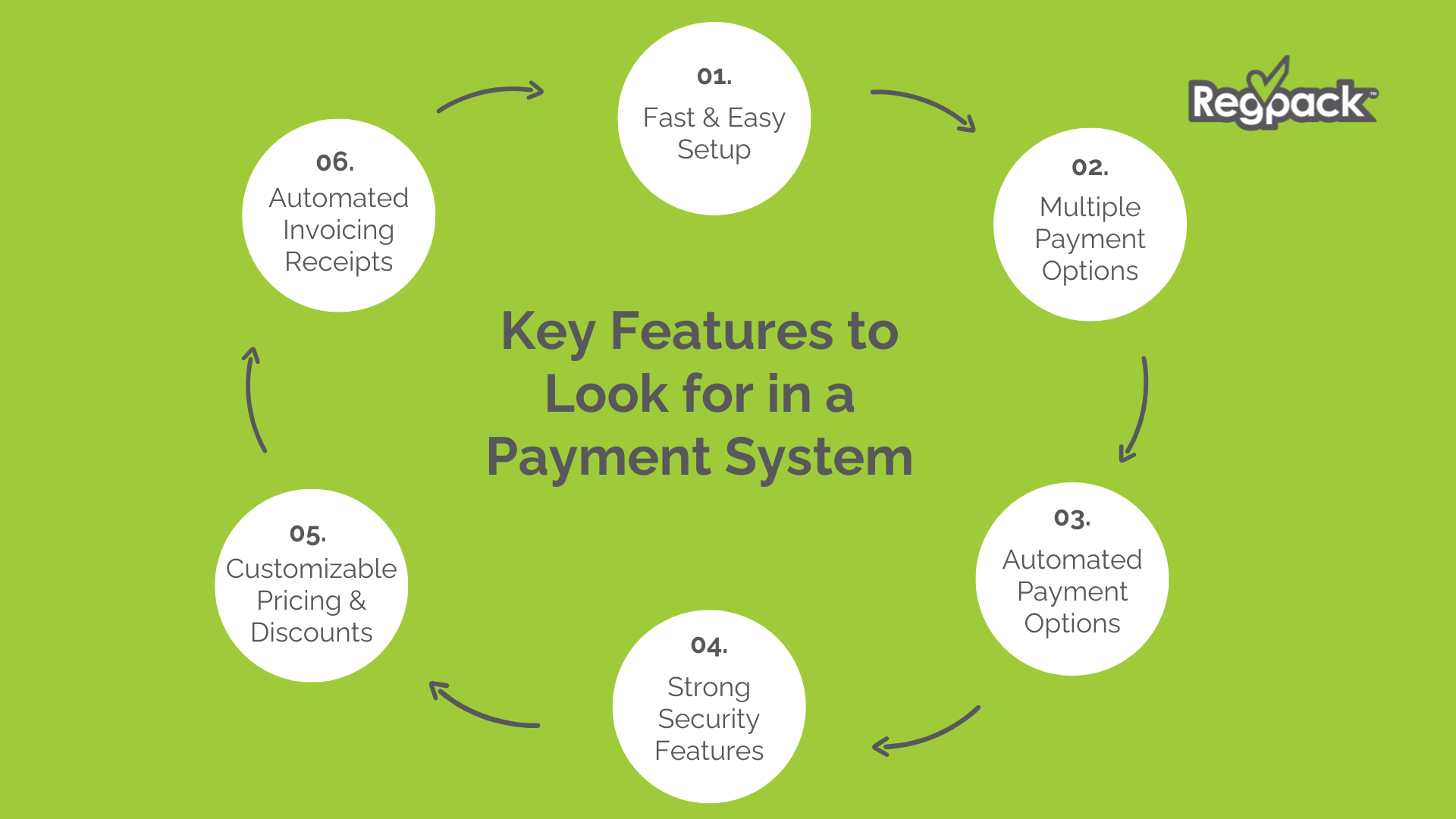

Key Features to Look for in a Payment System

Choosing the right payment system is crucial for handling your event payments efficiently. Whether you’re organizing a conference or a fundraiser, a reliable process makes transactions easier for both you and your attendees.

Here are the key features to look for in an event payment platform:

Fast and Easy Setup

A great registration software should let you start collecting event payments without a complicated setup. It should easily work with your event website without requiring technical skills.

Multiple Payment Options

People like choices when making a payment. A good system should support:

- Credit cards and debit cards

- Direct bank account transfers

- Digital wallets like Apple Pay and Google Pay

- Recurring billing for subscription-based events

Automated Payment Processing

A reliable payment processor moves transactions quickly and reduces the chance of errors or delays. This allows you to get paid faster while cutting down on manual work.

Strong Security Features

Your payment gateway should be PCI-compliant and encrypt personal information to prevent fraud. A secure payment system helps protect both attendees and your business from potential risks.

Customizable Pricing and Discounts

From early-bird pricing to group discounts, your registration payment system should allow flexible pricing models. This is especially helpful for nonprofit organizations offering tiered donations or special rates.

Automated Invoicing and Receipts

A great event management software helps with financial tasks by:

- Sending confirmation emails and receipts

- Tracking ticket sales

- Generating invoices for tax records

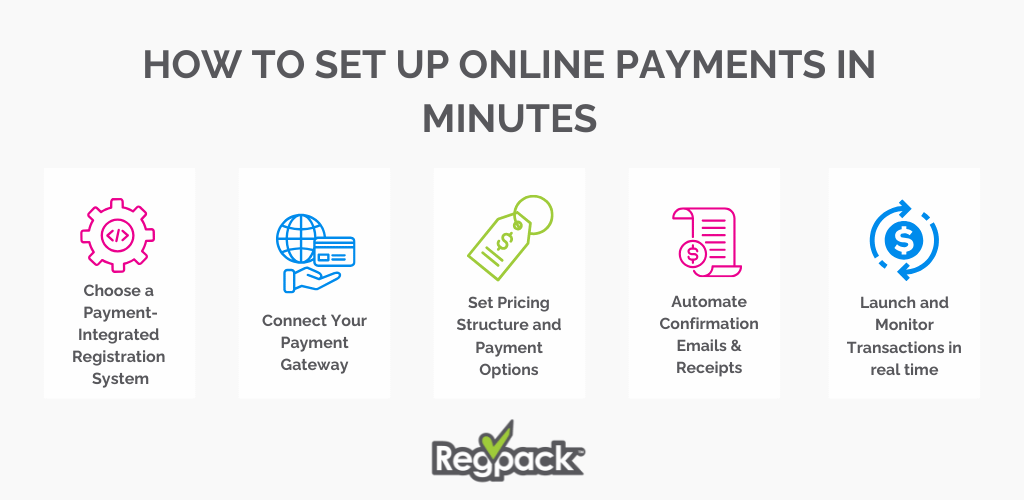

Step-by-Step: How to Set Up Online Payments

Step 1: Choose a Payment-Integrated Registration System

Select registration software that has built-in payment processing capabilities. This will allow you to manage everything from sign-ups to payment collection all in one place, without needing separate systems for each task.

Step 2: Connect Your Payment Gateway

Choose a trusted payment processor to handle transactions. Linking your payment gateway to your bank account creates a smooth transfer of funds, allowing you to securely accept payments from attendees.

Step 3: Set Your Pricing Structure and Payment Options

Decide how you want to charge for your event. Whether you’re using a flat fee, tiered pricing, or offering discounts, your payment system should be flexible enough to accommodate these options. You can also set up payment plans if your event requires installment payments.

Step 4: Automate Confirmation Emails and Receipts

Once a transaction is processed, automatically send a confirmation email with the event details and a receipt of payment. This keeps your attendees informed and helps you track registration payments with ease.

Step 5: Launch and Monitor Transactions

Once your payment system is live, monitor transactions in real-time. This allows you to quickly resolve any issues and stay on top of ticket sales and revenue. A reliable system will also allow you to track the status of payments and detect any potential problems immediately.

The Benefits of Using Regpack for Event Payment Processing

Regpack is an all-in-one registration software designed to simplify business registrations and workflows. With its built-in payment tools, we help event organizers manage payments quickly and efficiently, ensuring a simplified experience for both the organizer and attendees.

One of the standout features of Regpack is our ability to process payments in real time, which allows organizers to track ticket sales and revenue instantly. This makes for faster access to funds and helps you stay on top of your event finances without delays.

We support a variety of payment methods, including credit card and ACH payments. Whether you’re accepting one-time payments or setting up payment installment plans, Regpack offers flexible solutions that meet the needs of your event. You can also set up recurring payments, which is ideal for events that require ongoing billing or subscription-based services

Our platform also provides payment reporting tools, enabling you to track transactions, monitor revenue, and customize reports to fit your needs. With Regpack, you have access to powerful reporting features to keep your finances organized and under control.

By using Regpack, event organizers can simplify their payment process, secure transactions, and improve the overall payment experience for attendees.