- The AUD/USD weekly forecast shows strong bullish sentiment.

- Powell emphasized the need for patience regarding rate cuts.

- US data on Friday revealed dismal retail sales.

The AUD/USD weekly forecast is positive due to reduced trade tensions despite expected RBA rate cuts.

Ups and downs of AUD/USD

The AUD/USD pair had a bullish week as the dollar fell due to a delay on Trump’s reciprocal tariff. However, there were days when the US currency rose during the week. On Tuesday, Powell emphasized the need for patience regarding rate cuts. Additionally, data on Wednesday revealed hotter-than-expected consumer inflation in January, which led to a decline in rate-cut bets.

-If you are interested in forex day trading then have a read of our guide to getting started-

However, the Aussie rose against the dollar when it became clear that Trump’s reciprocal tariffs would not come immediately. Moreover, data on Friday revealed dismal retail sales, indicating weak consumer spending.

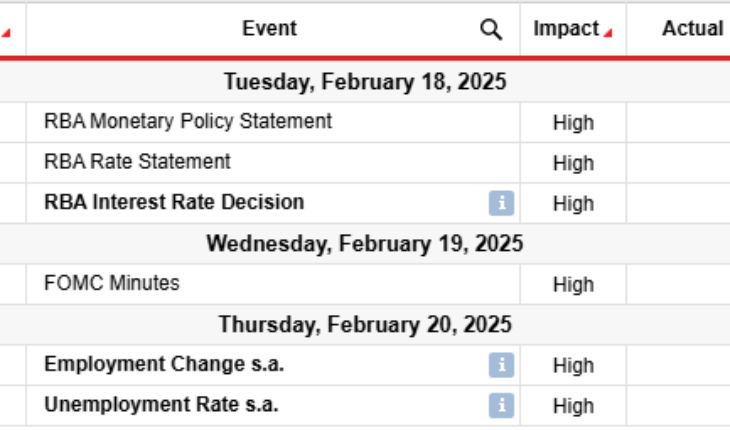

Next week’s key events for AUD/USD

Next week, traders will focus on the Reserve Bank of Australia policy meeting. Additionally, Australia will release its monthly employment report. Meanwhile, the US will release the FOM policy meeting minutes.

Most economists, as cited by Reuters, believe the RBA will cut interest rates by 25-bps on Tuesday. This would be the first rate cut, indicating policymakers are confident inflation is on a path to the target. Moreover, a dovish tone during the meeting would hurt the Australian dollar.

Meanwhile, the FOMC meeting minutes will show what went into the last decision to keep rates unchanged. Moreover, it might contain clues about future moves.

AUD/USD weekly technical forecast: Bullish momentum stronger above 0.63

On the technical side, the AUD/USD price has broken above the 0.6300 resistance level to make a higher high. Moreover, the price trades above the 22-SMA with the RSI above 50, supporting a bullish bias. The new high confirms a bullish reversal, meaning the price might keep climbing.

-Are you looking for the best AI Trading Brokers? Check our detailed guide-

Initially, the price was on a strong downtrend that paused below the 0.6300 support level. Here, bears lost the enthusiasm to make significant swings. At the same time, while the price made lower lows, the RSI made higher ones, indicating fading momentum. This allowed bulls to resurface and push the price above the 22-SMA.

Additionally, the price broke above the 0.6300 resistance, confirming the bullish shift in sentiment. Therefore, AUD/USD might reach the next resistance at 0.6500.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.