Capital expenditures are expected to be approximately $15M.

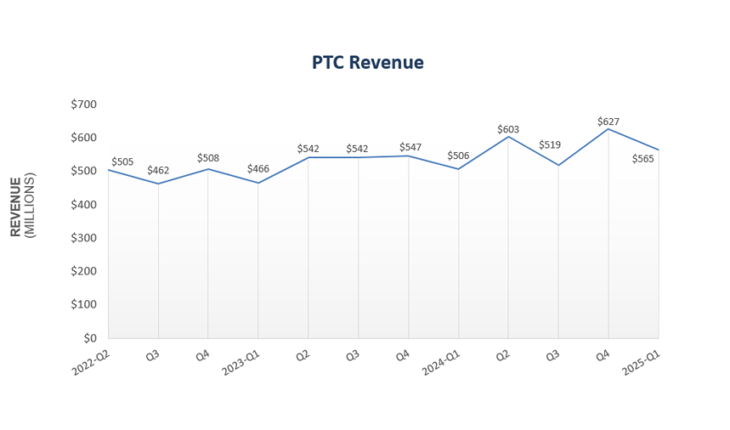

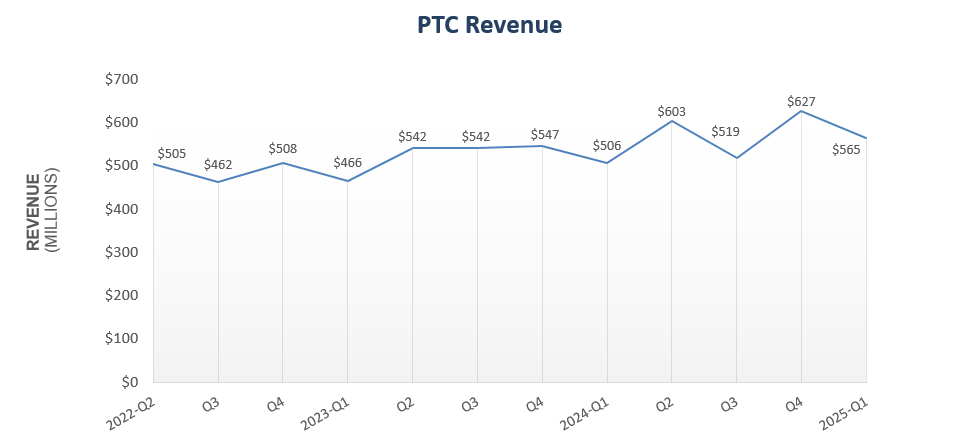

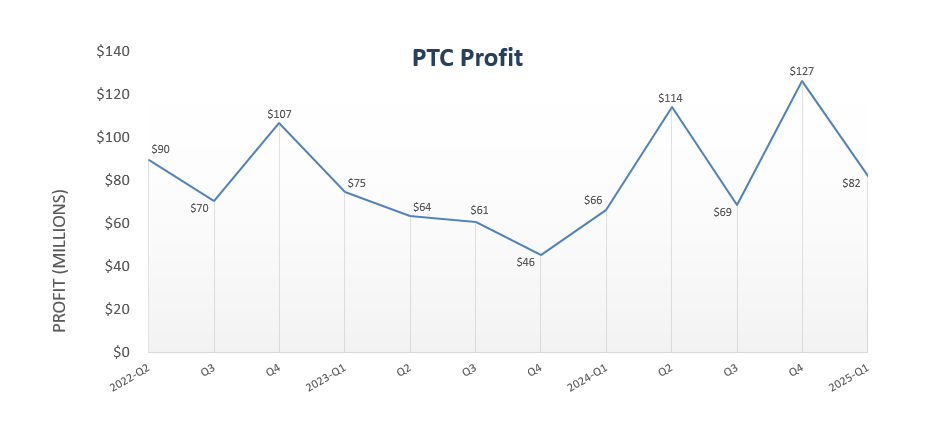

BOSTON, MA, Feb 6, 2025 – PTC reported financial results for fourth fiscal quarter and full fiscal year ended September 30, 2024. This quarter’s revenue stood at $565.1M, down 9.9% compared to $626.5M in the fourth quarter of 2024, with a profit of $82.2M.

“In Q1’25, we delivered solid year-over-year constant currency ARR growth of 11% and cash flow growth above 25%, which was in-line with our guidance. Our differentiated strategy leverages our unique portfolio to help product companies accelerate their time to market and manage increasing complexity. It’s an exciting time because our products are at the epicenter of driving business transformation at our customers,” said Neil Barua, president and CEO, PTC.

“In order to better serve the needs of our customers and strengthen our ability to drive consistent growth, in Q1’25, we began the realignment of our go-to-market organization to align with the vertical industries we serve. We will continue to focus on optimizing how we operate, so we can increase customer value while also enhancing shareholder returns,” concluded Barua.

“In a selling environment that continued to be challenging, our Q1’25 ARR grew 11% year over year on a constant currency basis. Our Q1’25 cash flow was solid, with operating cash flow growing 27% year over year and free cash flow growing 29% year over year, driven by ARR growth and a disciplined process for incremental investment in our business. Additionally, as we indicated, we resumed share repurchases, buying back $75 million worth of our stock in Q1,” said Kristian Talvitie, CFO.

“Given our differentiated product portfolio, the resilience of our subscription business model, the actions we have taken over time to align our investments with market opportunities, and allowing that our go-to-market changes are expected to take time to have their intended effect, we expect Q2’25 constant currency ARR growth of approximately 9.5%. Supported by ARR growth, the predictability of our cash collections, the disciplined budgeting structure we have in place, and being mindful of foreign exchange rate fluctuations, we expect Q2’25 free cash flow of approximately $270 million. We also intend to continue to execute on our share repurchase program, with approximately $75 million of buy backs expected in Q2’25,” Talvitie concluded.

A complete chart of the financial results is available here.

For more information, please visit ptc.com.