- The Fed kept rates unchanged on Wednesday.

- Trump emphasized his plans to impose tariffs on Canada and Mexico.

- Australia’s inflation came in softer than expected.

The AUD/USD weekly forecast shows downside potential amid increasing RBA rate cut bets and a stronger greenback.

Ups and downs of AUD/USD

The AUD/USD price had a bearish week amid hawkish Fed signals and increased RBA rate cut expectations. The Fed kept rates unchanged on Wednesday and failed to give any indication of near-term rate cuts. As a result, the dollar strengthened. Moreover, Trump emphasized his plans to impose tariffs on Canada and Mexico, boosting the greenback.

Meanwhile, inflation figures in Australia revealed a smaller-than-expected 0.2% increase, boosting bets for a Feb RBA rate cut, weighing on the Aussie.

Next week’s key events for AUD/USD

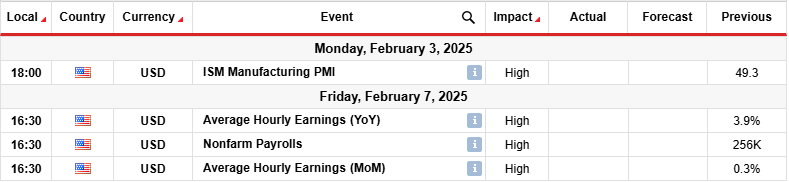

Next week, the US will release data on manufacturing business activity and monthly employment. The manufacturing PMI will show the health of the economy, shaping the outlook for US monetary policy. An unexpected increase in business activity will show resilience, while the opposite will show weakness.

Meanwhile, the US nonfarm payrolls will show job growth in January. The last report revealed an unexpected increase of 256,000 jobs, indicating a robust labor market. Another such report will boost the dollar as it will slash Fed rate cut expectations. On the other hand, if employment eases, policymakers might gain more confidence to lower borrowing costs.

AUD/USD weekly technical forecast: Price pauses in the 0.6151- 0.6300 range

On the technical side, the AUD/USD price has entered a period of consolidation between the 0.6151 support and the 0.6300 resistance. The range follows a strong downtrend that paused near the 0.6151 support level. Here, bears showed weakness as the RSI made a slight bullish divergence. This consolidation might be a pause in the downtrend or before a reversal.

-If you are interested in knowing about scalping forex brokers, then read our guidelines to get started-

If it is the first case, bears will challenge the range support next week. A break below this level will allow AUD/USD to make a lower low, continuing the downtrend. On the other hand, if it is a looming reversal, the price will break above the range resistance to revisit the 0.6500 key level.

Bulls will confirm a new bullish trend when the price starts making higher highs and lows. However, before the price resumes a trend, it might remain in consolidation for a while.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.