- US core inflation missed forecasts in December.

- US retail sales increased by a smaller-than-expected figure.

- Bank of Japan policymakers signaled a willingness to hike interest rates.

The USD/JPY weekly forecast indicates growing anticipation for a Bank of Japan rate hike that is supporting the yen.

Ups and downs of USD/JPY

The USD/JPY pair ended the week lower as the dollar eased on downbeat data, and the yen gained due to a surge in BoJ rate hike expectations. The greenback and Treasury yields eased after data revealed that US core inflation missed forecasts in December. The report raised expectations for Fed rate cuts in 2025. Additionally, retail sales increased by a smaller-than-expected figure, pointing to weak consumer spending.

-Are you interested in learning about forex tips? Click here for details-

Meanwhile, Bank of Japan policymakers signaled a willingness to hike interest rates due to the improving economy and weak yen. Consequently, rate hike bets increased, boosting the yen.

Next week’s key events for USD/JPY

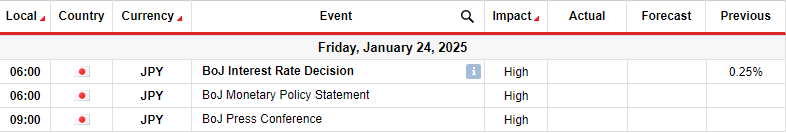

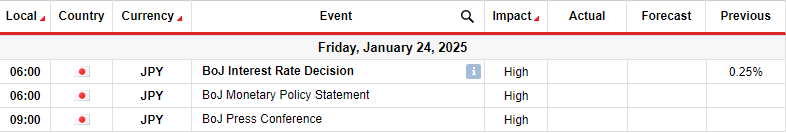

Next week, market participants will watch the Bank of Japan policy meeting on Friday. The yen has faced significant downward pressure due to the rising dollar and a less dovish outlook for Fed policy. At the same time, the BoJ has remained cautious about rate hikes, citing uncertainty about Trump’s policies.

However, recent yen weakness has increased pressure on the central bank to hike rates. As a result, policymakers have shifted their tone to a more hawkish one, boosting rate hike expectations. If policymakers vote to hike rates on Friday, the yen will rally.

USD/JPY weekly technical forecast: Trendline support retested

On the technical side, the USD/JPY price has paused at its support trendline after breaking below the 22-SMA. The SMA break indicates a bearish shift in sentiment. However, on a larger scale, the price trades in a bullish trend with a clear support trendline.

-Are you interested in learning about the forex basics? Click here for details-

Therefore, although bears are in the lead in the short term, the price is making higher highs and lows. Bulls might resurface next week to push the price off the support. However, they must make a higher high to confirm a continuation of the bullish trend.

However, while the price has made higher highs, the RSI has stalled, failing to enter the overbought region. This could be because the uptrend is a corrective after a strong trend. If this happens, the price will likely break below the trendline to make another impulsive leg. Therefore, it would breach the 150.05 support level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.