- Business activity in the US services sector improved more than expected.

- The US economy added 256,000 jobs in December.

- US unemployment dropped to 4.1%, below estimates of 4.2%.

The GBP/USD weekly forecast suggests further weakness as the US dollar picks momentum after robust jobs data.

Ups and downs of GBP/USD

The GBP/USD pair had a bearish week as the dollar rallied amid upbeat US economic data. Figures revealed that business activity in the services sector improved more than expected. Meanwhile, employment numbers were mostly better than expected.

-Are you looking for tips for forex trading? Check out the details-

Notably, the nonfarm payrolls report on Friday showed an unexpected surge in job growth and a drop in the unemployment rate. The US economy added 256,000 jobs in December, compared to forecasts of 164,000. Meanwhile, unemployment dropped to 4.1%, below estimates of 4.2%. Consequently, Fed rate cut bets plunged, boosting the dollar.

Next week’s key events for GBP/USD

Next week, market participants will focus on inflation and retail sales data from the US and the UK. At the same time, the UK will release figures on manufacturing production and GDP. The US wholesale and consumer inflation numbers will shape the outlook for future Fed rate cuts. Recent reports have shown that inflation has paused its decline to the 2% target. Another upbeat report will lower expectations for rate cuts, boosting the greenback.

Similarly, UK inflation and retail sales will guide the outlook for Bank of England rate cuts. Upbeat reports will lower bets for rate cuts, while downbeat numbers will further hurt the pound.

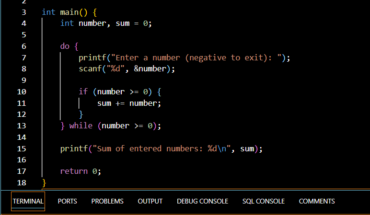

GBP/USD weekly technical forecast: Bears eye new lows below 1.2250

On the technical side, the GBP/USD price has punctured the 1.2250 support level to make a new swing low in the downtrend. The price trades well below the 22-SMA, showing bears are holding the reigns. Meanwhile, the RSI has entered the oversold region, suggesting solid bearish momentum.

-Are you looking for automated trading? Check our detailed guide-

GBP/USD has maintained a solid downtrend since the price broke below the 22-SMA. In all this time, the RSI has stayed in bearish territory but has failed to dip into the oversold region. This shows that bears still have more room to push the prices lower. Therefore, the break below the 1.2250 support will allow the price to reach lower support levels.

Moreover, the trend will only reverse if the RSI shows fading momentum and the price breaks above the 22-SMA.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.